Nicholas Dew and Ira Lewis

18 May 2022

https://doi.org/10.36304/ExpwMCUP.2022.07

PRINTER FRIENDLY PDF

EPUB

AUDIOBOOK

Abstract: Defense innovation systems (DIS) have become an important analytic concept in defense policy circles in recent years. DIS are networks of interacting agents involved in the generation, diffusion, and utilization of defense-related technologies supported by local institutional infrastructures. This notion can be a valuable addition to one’s arsenal of tools for understanding aspects of great power competition between the United States and China. The DIS construct draws attention to competition between the United States and China being fundamentally a contest between different innovation systems. This adds an important perspective to policy debates because it broadens the analysis of competition away from particular elements and toward the overall systems involved, including global technological systems, dual-use technologies, and civilian elements that are important components of nearly all innovation systems. Furthermore, while U.S. industrial policy may have historically hidden it, the DIS construct draws attention to the intensive management and networking activities by U.S. Department of Defense elements involved in organizing the generation, diffusion, and utilization of defense-related technologies. For China, the DIS construct helps shed a bright light on the civilian-military fusion that has been a bedrock of China’s international competitive strategy.

Keywords: defense innovation system, national system of innovation, innovation network, innovation ecosystem, industrial policy

Introduction

In 1972, Andy W. Marshall wrote in Long-Term Competition with the Soviets: A Framework for Strategic Analysis that to compete with the Soviet Union over the long-term, “a fundamental part of the U.S. strategy may be to push innovation in technology vigorously.”1 In many ways original, one of Marshall’s key insights was to see competition between the United States and its adversaries as one between different “systems.” In Marshall’s thinking, it was the relative speed of innovation in those systems that would matter most for military competitiveness over the long run.

Marshall was, of course, well ahead of his time. The term innovation system is now routinely used to describe the large number of participants and resources configured to support innovation in a particular nation or industrial sector.2 It is widely accepted that these systems differ according to national and sectoral characteristics that are shaped by local institutions.3 While there may be only one set of fundamental principles for how innovation systems work, there are a great many local recipes that are possible.4 Furthermore, it is by now broadly appreciated that the U.S. Department of Defense (DOD) has run networks to influence innovation since the 1950s that have been sheltered from public view because of the dominance of market fundamentalist ideas in U.S. policy circles.5

This article considers defense innovation systems (DIS) as a concept whose time has come.6 DIS are networks of interacting agents involved in the generation, diffusion, and utilization of defense-related technologies supported by local institutional infrastructures.7 The rivalry between different innovation systems has emerged as a defining feature of great power competition.8 By now, it is quite clear that the United States has entered a period of system-on-system competition with China in which each nation faces increasing competitive pressure from the other, resulting in an arms race dynamic between U.S. and Chinese DIS. Top officials in U.S. national security and analysts in the policy community have released a succession of reports highlighting rapid improvements in Chinese military capabilities. In a 2020 report, U.S. Air Force chief of staff General Charles Q. Brown Jr. stated that, “Competitors, especially China, have made and continue aggressive efforts to negate long-enduring U.S. warfighting advantages.”9

Bharat Rao et al. argue that, in general, the world has entered a period of hyper-innovation in which the “military-industrial complex and commercial industry alike are subject to continuous business process and technology disruption.”10 As Melissa Flagg and Jack Corrigan note, national security analysts are collectively calling out the same problem: “As commercially developed, dual-use technologies transform the national security landscape, the DOD must harness the full potential of the U.S. innovation ecosystem to maintain the country’s competitive edge.”11

This competitive struggle encompasses a complex landscape of multiple globalized innovation systems that vary technologically and institutionally. It is easy to overlook and oversimplify the intricate constellation of innovation systems, the full spectrum of participants, and the multidimensional nature of relationships in these systems. However, from an analytical standpoint, a decisive simplification is the distinction between major weapons systems (MWS) and dual-use technology (DUT). For analytical purposes, this simplification, though crude, provides a critical distinction.

In the United States, MWS are produced by a segment of the overall DIS that is dominated by the “Big Six” defense contractors: Lockheed Martin, Raytheon Technologies, Boeing, Northrop Grumman, General Dynamics, and BAE Systems. These firms are organized as traditional vertically integrated organizations, though on closer inspection they are conglomerates of related entities. The MWS subsystem is also characterized by collaboration and partnerships between the primes, such as the well-known F-35 Global Partnership.12 There are also large numbers of subcontractors for MWS and some international partnerships, although their relationship with DOD entities is frequently mediated by one of the primes. Within the MWS subsystem, the DOD plays the role of “kingpin” through contractual, regulatory, and organizational processes. The MWS subsystem is adapted to the unique institutions of the United States, particularly the role that Congress plays in defense policy and spending.13

Currently, policy attention has largely shifted away from MWS and toward the constellation of innovation systems that create and supply DUT. There is a broad consensus that during the past two decades, the military relevance of DUT has grown relative to MWS, partly because DUT is such an integral component of MWS and partly because of the widespread adoption of DUT for military purposes.14 Much DUT is produced by a global innovation system-of-systems that is differentiated more according to technical sectors and less according to national boundaries.15 The DOD’s position in the DUT landscape is very different than in that of MWS, as it is a participant rather than the kingpin/dominant customer. In some respects, the DOD’s role is merely one of the dozens of large participants with little special influence, occupying a place in a huge and complex system of systems and in competition with a wide variety of other participants.

Importantly, DUT is produced by a dynamic, open innovation system that has evolved rapidly during the past 20 years, with many new participants collaborating and competing in a bewildering number of ways. DUT is therefore characterized by many competing efforts to shape and control its evolution, including the influence of other defense-oriented participants (e.g., China) that have long-running and well-developed strategies for leveraging DUT to their advantage. However, the systems that produce DUT are also influenced by many players whose primary agenda is not defense and whose goals may be in direct competition with the agenda of the DOD.

While the DOD has some tools at its disposal for influencing aspects of the DUT system, the relationship is largely one marked by DOD dependence. To illustrate this point, consider first the differences in size between the MWS and the DUT systems. Semiconductors are an example of just one sectoral innovation system that is a DUT.16 The semiconductor system alone generates approximately 50 percent more revenue than the entire Big Six do ($433 billion for the semiconductor system in 2020, compared to around $300 billion for the Big Six, which includes its commercial and international sales).17

Within semiconductors, one significant subsector is field-programmable gate arrays (FPGAs). FPGAs are an extremely important component in defense weapon systems. Yet, there are six business segments in FPGAs: consumer electronics, automotive, industrial, telecommunications, data processing and, finally, aerospace and defense. Hence, as important as FPGAs are to the defense sector, defense is certainly not the most important sector to FPGA producers, let alone the entire semiconductor sector.

This fundamental asymmetry—that the DOD depends on DUT, but the DUT innovation ecosystem does not generally depend on the DOD—is repeated across the enormous spectrum of DUT. Research and development (R&D) provides another example of this asymmetry. According to Christian Brose, the Big Six invested $6 billion in R&D during 2019, whereas the top six global information technology (IT) firms (including Apple, Google, and Amazon) invested $70 billion.18

While the DOD has benefitted from commercial R&D spending on DUT, many of the benefits of this private-sector spending also spill over to adversaries who may be able to adopt DUT for defense purposes faster than DOD entities can.19 By relying on the same legal and contracting arrangements that it uses for MWS, the DOD has made itself an unattractive partner for many DUT vendors.20 Defense users have idiosyncratic demands that add cost to products, volumes are low compared to consumer markets, and the defense acquisition process is very lengthy and costly for would-be suppliers. When everything is considered, DOD entities simply may not pay well enough to justify the opportunity cost to DUT vendors of doing business with them.21

The differences in the scale and scope, R&D intensity, and dynamic pace between DUT and MWS did not matter that much to the DOD as long as DUT was of limited relevance in military competition. However, that situation has changed dramatically during the past 20 years, as nuisance hacking has morphed into offensive cyber warfare and Roomba robot vacuums have evolved into swarms of killer drones.22 In ways that were largely unimaginable a generation ago, DUT has become a vital source for military capabilities, including many technologies that are required for MWS to be effective. As a result, a significant part of military innovation competition is migrating—or has already migrated in significant ways—from MWS to DUT.23

The extent of this shift is highlighted in a recent foresight study conducted by the Rand Corporation for the European Parliament on future battlefield technologies.24 The study highlights six major technology clusters that are expected to be influential in future warfare.

Table 1. Overview of key new and emerging technology clusters

| Technology cluster |

Definition |

| Artificial intelligence, machine learning, and big data |

Software technologies that are able to perform advanced computing to analyze and interpret large quantities of data. |

| Advanced robotics and autonomous systems |

Technologies that constitute or enable the operation of unmanned vehicles with advanced capabilities, including in the area of operating without human supervision or control. |

| Biotechnology |

Technologies that leverage biological systems or innovations in biological sciences to develop systems with advanced properties and levels of performance. |

| Technologies for the delivery of novel effect |

Technologies, including weapons and subsystems, that enable the delivery of novel kinetic and nonkinetic effect or the delivery of conventional effect in novel ways. |

| Satellites and space-based technologies and assets |

Technologies that enable access to space or technologies that are space-based and facilitate terrestrial or space-based operations. |

| Human-machine interfaces |

Technologies that facilitate human-machine interactions or human-machine teaming, including information transfer. |

Source: adapted from Jacopo Bellasio et al., Innovation Technologies Shaping the 2040 Battlefield (Brussels, Belgium: European Parliament Research Service, 2021), 21.

Four of these technology clusters are DUT: artificial intelligence (AI), machine learning, and big data; advanced robotics and autonomous systems; biotechnology; and human-machine interfaces. A fifth cluster, satellites and space-based technologies and assets, is rapidly evolving in a dual-use direction. Only the final cluster, technologies for the delivery of novel effect (which includes hypersonic and directed energy weapons), is a traditional MWS.

Which nations are best positioned to gain competitive advantage from these changes? Extant research predicts that challenger nations generally benefit when innovations become easier to adopt.25 Military innovations can be easier to adopt when they are based on commercial off-the-shelf (COTS) DUT because defense and commercial purchasers share the costs of creating these new technologies. This not only spreads overall cost and makes individual units cheaper, but it also makes it less likely that the technologies involve large capital investments (e.g., aircraft carriers), which further lowers the barriers to acquiring these technologies. Both lower unit costs and lower barriers benefit challenger nations by making new technology more accessible and affordable to them. When new technologies are disruptive, this also benefits challenger nations, since they are in a better position to completely bypass or “leapfrog” previous generations of technologies.26 By comparison, incumbent powers are likely to be more heavily invested in existing technology capabilities that are at risk of becoming “stranded” by leapfrog technologies. Therefore, in general, incumbent powers such as the United States bear more risk of disruption from new technologies than challenger powers do.

The major exception to this pattern is when new technologies significantly increase the value of existing military capabilities. In these instances, the new technology complements existing capabilities rather than disrupting them.27 When this happens, incumbent powers stand to benefit, but only if they integrate the new technologies into their existing capabilities, and only if these new combinations overall outweigh the advantages of starting with a clean slate.

This combination of factors means that challenger powers such as China have experienced some structural advantages from the rapid evolution of DUT during the past 20 years, which has provided numerous new opportunities for technology adoption.28 Despite the DOD’s Third Offset initiatives, China appears to have been more adept at exploiting DUT innovation adoption opportunities than the United States has.29

The rising importance of DUT as a source of military-relevant technologies during the past 20 years has also rewarded nations that have prioritized integrated civilian-military technology strategies, as compared to those with an institutional focus on MWS. In this regard, the United States has been playing only half of the innovation game, whereas China has been playing the whole game.30 Undoubtedly part of this difference is due to the United States’ extended wars in Afghanistan and Iraq during this period, which served to focus U.S. defense R&D investments on projects with short-term utility. However, part of the explanation for this divergence is also structural, in that China has benefited from adopting a mercantilist economic model that strongly integrates civilian and military technology development and adoption.31

In a period in which DUT has become an important source of new military capabilities, countries with integrated civilian-military economic strategies have had more to gain. As a result, the U.S. policy of leaving industrial development to market forces has become increasingly costly in military terms during the past 20 years.32 In a telling recent remark about competition with China, Senator Mark Warner (D-VA) suggested, “It’s hard to see how . . . any normal, traditional market-based economy can compete against that kind of juggernaut and win.”33

Close U.S. allies such as the United Kingdom have taken note and launched their own integrated strategies in response.34 Since the United States has simply continued with the same policy tools it used successfully for competition with the Soviet Union during the Cold War, one might be forgiven for thinking they would work the same way again. However, China’s civilian and military development policy is a far cry from the simple strategies of the centrally planned economy used by the Soviet Union. The Soviet Union did not compete with the United States based on a sophisticated and expansive hybrid economic model that fuses civil and military technology development together—but China does. China has used numerous long-term policies to carefully cultivate and shape DUT innovation ecosystems to its advantage, with 5G telecommunications being perhaps the best-known example.

Therefore, while the lack of a deliberate U.S. strategy for DUT was never an exploitable weakness in the Cold War era, competition from China has exposed this deficiency in the U.S. policy system. Moreover, it is a very problematic weakness for the United States because it is deeply rooted and difficult to change.35 Despite all the strengths of the U.S. national innovation system, it is one in which the speed of evolution of military capabilities is still largely an indirect function of how well the country’s institutions channel the profit maximization incentives of corporations rather than the security needs of the nation.36

The concept of defense innovation systems is a powerful abstraction. In the context of increasingly numerous and urgent calls about the rising military power of China, the innovation systems construct may be helpful for analyzing competition between the DIS of the United States and China. In that vein, empirical research could investigate the relationship between China’s “Military-Civil Fusion” doctrine and the growth and development of its military.37 Defense practitioners may also want to expand their awareness about how the innovation system framework can be valuable for analyzing and assessing critical national security issues.

To unlock insights relevant to policymakers, this article will first review and appraise some of the most relevant important background research for understanding key ideas about DIS. The perspective of the authors is deliberately more managerial than some prior reviews because they believe that this is most useful for policymakers. Their observation is that defense managers have been engaging with networks of organizations for a long time, working in various ways to promote innovation by bringing relevant public and private organizations together during the course of many decades.38 The authors focus on micro-level insights from management research that complement the macro-level themes that are traditionally highlighted by “innovation systems” and “ecosystems” research in the fields of economics and political science. These have been reviewed at length elsewhere, whereas the relevant management research has not.39 Building on a variety of intellectual foundations, it is only quite recently that the DIS perspective has been brought into focus and its core concepts fully articulated.40

Second, the article will discuss the application of these ideas to the current competitive environment with a focus on speed as the objective that matters most. Since the near-peer competitors of the United States appear to be accelerating their fielding of new defense equipment, the authors focus on how DIS ideas can help U.S. policymakers better understand the strengths and weaknesses of the U.S. system. Critical to this understanding is differentiating among the innovation subsystems that comprise the overall U.S. DIS. Because of the nature of upstream R&D and downstream demand conditions, these subsystems do not behave the same, and recognition of this is an important part of understanding their differences.

Finally, the article will close with a brief section that summarizes the authors’ key takeaways for policymakers from applying an innovation systems approach to the DOD’s current competitive challenges. Here they will attempt to sketch out some preliminary ideas about how policymakers may be able to use what they know about innovation systems to improve the United States’ competitive position vis-à-vis China.

Background

Innovation and Networks

The case of networks being used to promote defense innovation may represent what Henry Mintzberg and James A. Waters refer to as “emergent strategy,” which occurs where a realized strategy was not expressly intended.41 Instead, individual actions, perhaps appearing unrelated to each other, were taken over time and resulted in a consistent pattern that afterwards is recognized as a strategy. Mintzberg et al. also suggest that the presence of an emergent strategy demonstrates an organization’s capacity to experiment and therefore learn.42 In a comment on “professional organizations”—which could certainly include the DOD—this experimentation provides the basis for change within an otherwise rigid structure:

Major reorientations in strategy—“strategic revolutions”—are discouraged by the fragmentation of activity and the power of individual professionals as well as their outside associations. But at a narrower level, change is ubiquitous. Individual programs are continually being altered, procedures redesigned, and clientele shifted. Thus, paradoxically, overall the professional organization is extremely stable yet in its operating practices in a state of perpetual change. Slightly overstated, the organization never changes while its operations never stop changing.43

In the context of DIS, government agencies have engaged in a series of initiatives since the 1950s that have provided learning opportunities for both the public and private members of the networks involved, as well as the technological advancements that were the explicit goals of each initiative. The emergent strategy referred to above de facto provided persistent support for the development of DIS through the creation of interorganizational networks. As Paul Cunningham and Ronald Ramlogan have commented:

Networks can allow for rapid learning and facilitate the reconfiguration of relationships—such as with suppliers (in the case of companies) or with producers of knowledge (which may be other companies or research institutions). Networks can stimulate the development of additional cooperative activities around a diverse range of issues including training, technological development, product design, marketing, exporting and distribution.44

The rapid learning referred to here has become particularly important as the pace of technological innovation and obsolescence has accelerated. This faster pace has accelerated the speed at which an organization must adapt to remain in front and counter the competitive response of adversaries. Accordingly, the use of networks is particularly important when the choice is made, consciously or not, to rely on emergent strategy.45

Mariana Mazzucato points out that in government agencies there are also wins and losses, and that losses need to be used as lessons learned to improve and renew future policies.46 Innovation goes beyond invention of new products or technologies to include the capability to “make good ideas stick” by ensuring that new ideas are applied to the benefit of end-users.47 Emergent strategy has therefore been characterized as a significant factor in government policymaking.48

Innovation Networks and National Security

The transition from invention to innovation has significant economic and national security implications. Innovation frequently takes place between diverse actors at the global level, making regulatory control by national governments difficult.49 As was mentioned previously, excluding the large firms that build MWS, the DOD must compete with other customers for the attention of innovative firms. As David C. Gompert notes:

Keep in mind that private high-tech development typically results from the interplay of scientific inquiry and market demand, rather than meeting the known requirements of a given customer. Emulating this model, R&D for the armed forces, intelligence services and other agencies must transcend existing specifications for platforms or products under contract. The right approach is to energise military and other government planners to engage in free-form thinking about the challenges they expect to face, such as those posed by China. This would lead to fresh concept development for refining such challenges and devising alternative ways of meeting them.50

In that vein, researchers have suggested that the United States must more aggressively support cooperation with allies on technological innovation, both for defense-specific systems and in the broader economy.51

In support of that objective, the United States participated in the inaugural meeting of the AI Partnership for Defense in September 2020. This consortium of 13 nations, led by the DOD’s Joint Artificial Intelligence Center (JAIC), has begun sharing lessons learned and best practices in harnessing AI for military applications. A major goal of the partnership is to help determine what will characterize “responsible AI” among democratic nations, for example the protection of individual privacy.52 According to the DOD, AI will soon play a critical role in the conduct of military operations:

AI and machine learning have the potential to revolutionize how war is conducted by rapidly speeding up the collection and processing of data and information to facilitate analysis and decision making. AI and machine learning can impact a range of U.S. military functions, including intelligence collection and analysis, logistics, cyber operations, information operations, command and control, and semiautonomous and autonomous vehicles.53

Close cooperation with U.S. allies is particularly important for the DOD, as China considers AI a leapfrog technology that could, for example, enable low-cost, long-range autonomous platforms to counter U.S. military conventional power projection.54 As Michael C. Horowitz has commented:

If commercially-driven AI continues to fuel innovation, and the types of algorithms militaries might one day use are closely related to civilian applications, advances in AI are likely to diffuse more rapidly to militaries around the world. AI competition could feature actors across the globe developing AI capabilities, much like late-19th-century competition in steel and chemicals. The potential for diffusion would make it more difficult to maintain “first-mover advantages” in applications of narrow AI. This could change the balance of power, narrowing the gap in military capabilities not only between the United States and China but between others as well.55

Allies, Partner Nations, and Innovation

While the United States is the world’s largest exporter of military technology, it also has a long history of adoption of weapon systems from other nations. For example, the U.S. Navy’s Arleigh Burke-class of guided missile destroyers use a Rolls-Royce gas-turbine engine to generate power, which is an adaptation of the Rolls-Royce engine used on the Lockheed Martin C-130 Hercules transport aircraft. BAE Systems, the U.S. subsidiary of the United Kingdom’s largest defense firm (BAE Systems plc), operates a shipyard in San Diego, California, which is modernizing the destroyers.56

The U.S. Marine Corps has retired the McDonnell Douglas AV-8B Harrier II attack aircraft, built by McDonnell Douglas (now Boeing) under license from English Electric (now BAE). The AV-8B is being replaced by the Lockheed Martin F-35B Lightning II fighter, which like the Harrier features a Rolls-Royce lift fan, in this case integrated with the F-35B’s Pratt & Whitney engine.57

Construction will begin in 2022 on the U.S. Navy’s Constellation-class frigates, built in Marinette, Wisconsin, by the U.S. subsidiary of the Italian shipbuilder Fincantieri Marine Group. The Constellation class is based on the FREMM European multimission frigate used in the Italian and French navies, which was designed by Fincantieri and the French shipbuilder Naval Group.58 In the U.S. Army, the Airbus EC145 light utility helicopter has been adopted as the Eurocopter UH-72A Lakota, assembled by Airbus Helicopters in Columbia, Mississippi.59 Finally, the Brazilian aerospace manufacturer Embraer has developed the C-390 Millennium twin-engine tanker/transport aircraft and established a partnership with Boeing that may lead to further development of the aircraft, which would be assembled in the United States for DOD customers.60

In this context of close cooperation on military technologies, the United States’ allies within the Five Eyes alliance (Australia, Canada, New Zealand, and the United Kingdom) as well as other allied nations are frustrated by complex bureaucratic barriers that do little to protect the U.S. economy or national security.61 The situation has in certain cases led to American firms and the U.S. government being excluded from participation in the development of important technologies by allied countries. Allied nations wish to bypass the cumbersome, lengthy, and often unrewarding approval processes that may be associated with U.S. participation.62 As a 2019 Council on Foreign Relations report on innovation and national security notes, the United States may be missing out on innovative technologies developed elsewhere:

Friends, allies, and collaborators tightly link technology ecosystems and create scale in a globalized system of innovation, and thus are a competitive advantage. Washington’s current trade policies needlessly alienate partners, raise costs for American tech firms, and impede the adoption of U.S. technology in foreign markets.63

There is also a lack of research into comparative national systems of defense innovation.64 As explained by Dylan Gerstel et al., the “interconnectedness of the global economy and innovation ecosystems means [that] unilateral approaches are unlikely to succeed.”65 Martijn Rasser et al. add that “decades of experience show that joint work with foreign researchers can be done with great benefit and little detriment to U.S. economic and national security.”66 For the United States, as for its allies, cooperation on innovation is particularly important to the need to build and sustain a military technology advantage.

Innovation Networks, Learning, and Collaboration

U.S. Air Force lieutenant colonel Matthew C. Gaetke recently explained the need for both organization learning and diversification of sources with respect to potential military technologies:

The right question is how to equip future wartime leaders with the broadest sheaf of technologies, since we cannot predict which will be the right ones, and then train them to make flexible decisions over their use. The nature of the war they could fight might be surprising. Preparing for that uncertainty means developing many options, not placing a few large bets, regardless of how promising a technology appears. This preparation requires a shift in strategic mentality, reframing perspectives on cost, risk, waste, and value.67

Examples of major U.S. initiatives that have provided a basis for future learning include the creation of the Defense Advanced Research Projects Agency (DARPA) in 1958, the U.S. space program that has existed since the creation of the National Aeronautics and Space Administration (NASA) the same year, and the funding and leadership provided to the U.S. manufacturers and universities that created the Semiconductor Manufacturing Technology (SEMATECH) consortium in 1988.68 Rao et al. offer an example of lessons learned from the space program:

One successful strategy included externalizing critical problems to collaborators around the world through a virtual problem-solving platform. Capitalizing on this approach, NASA not only figured out a way to increase the scale and diversity of its “solver” community, but also facilitated greater internal collaboration through the refinement of externally sourced ideas involving participants from different parts of the NASA enterprise.69

A relatively high tolerance of risk underlies long-term success in technology development initiatives. For example, DARPA is “very tolerant of failure if the potential payoffs are high enough.”70 If government policies fail to support risk-taking, then the projects that do get funded with the budget available will tend to not be particularly innovative, which undermines the objectives of any program or initiative.71 In addition, the DOD’s innovation policies have traditionally focused heavily on technical research and development and accelerating the speed of the acquisition process rather than strengthening the ability of the broader organization to innovate.72

Accordingly, DARPA has been called the “flagship disruptive innovation organization of the Department of Defense,” which has led to emulation by countries around the world.73 The DARPA approach is particularly appropriate for the United States and its allies given the return to great power competition. As noted in a 2019 report by the Ronald Reagan Presidential Foundation and Institute:

China’s military–civil fusion concept draws from the U.S. model of the Defense Advanced Research Projects Agency (DARPA) and federally funded laboratories but represents an attempt to leverage all aspects of the civilian economy on behalf of national defense. It is characterized by comprehensive government direction, support, and funding for “national champion” companies and mandated coordination among the academic, private sector, and military spheres. This military–civil fusion concept appears especially well-suited to exploit the dual-use technologies central to the 21st-century military–technical competition. Thus, the U.S. NSIB [national security and innovation base] must compete against a Chinese innovation base that uses top-down, long-term planning to exploit innovation wherever it might occur—be it in the business, academic, or government sectors.74

To a certain extent, leveraging the use of innovation ecosystems by the DOD parallels similar changes in the private sector. Major defense and technology firms within the United States and peer nations have shifted from vertically integrated structures to networks of partners.75 This transition is particularly important as most DUT comes from outside the government or defense-oriented firms.76 (Some examples of these technologies will be provided later in this article.) In this context, networks become key for the creation and survival of knowledge-intensive entrepreneurial activities.77 The U.S. Navy’s NavalX Tech Bridge network is one example. As explained by former assistant secretary of the Navy for research, development, and acquisition James F. Geurts, “the power of these Tech Bridges [networks supported by the U.S. government] is they’re not on bases, they’re not behind barbed wire, they’re not just only a requirements-pull. It’s a way that we can get idea-push.”78

Networks may operate in unpredictable manners relative to traditional vertical structures but in ways that can be shaped to meet desired goals.79 However, the governance of the network must be sufficiently strong to ensure that its viability and ongoing existence. Otherwise, the network will fail as its member institutions opt out, as described somewhat explicitly by Josh Whitford and Andrew Schrank:80

Network governance is functional in organizational fields characterized by unstable demand, dispersed and rapidly changing knowledge, and complex interdependencies between component technologies. But it may nonetheless fail in those fields, and it does so when exchange partners either screw each other or screw up. They are more likely to screw each other when formal and informal institutions fail to inhibit opportunism; they are more likely to screw up when such institutions fail to facilitate the search for new information beyond the network. When the institutions in question simultaneously inhibit opportunism and facilitate search, network governance becomes viable—at least insofar as technological and demand conditions render it desirable. However, when such institutions neither mitigate opportunism nor facilitate search, network production is all but impossible and stillbirth or devolution—that is, absolute network failure—occurs.81

In industries that possess an expanding knowledge base and where expertise is widely dispersed, the locus of innovation will be found in the overall network rather than in individual firms.82 Although the increasing prevalence of networks in innovation has reinforced the tendency toward globalization, the same trend has also reinforced the importance of the home nation.83 There is also an interplay between national capabilities and the inter-relationships of individual technologies, as described by Robert W. Rycroft and Don E. Kash:

A history of flexible and adaptive learning relationships within a network (with suppliers, customers, and others) provides member organizations with formidable sources of competitive advantage. Alternatively, allowing learning-based linkages to atrophy can lead to costly results. For instance, inadequate emphasis on manufacturing and a lack of cooperation among semiconductor companies contributed to an inability to respond rapidly to the early 1980s Japanese challenge. When the challenge became a crisis, cooperative industry initiatives moved U.S. companies toward closer interactions with government (such as the Semiconductor Trade Arrangement) and eventually to a network (the Sematech consortium) that improved the ability of industry participants to learn in mutually beneficial ways, including collaborative standards setting.84

Erica R. H. Fuchs provides the example of DARPA program managers, who act as “embedded agents” that are central nodes in social networks.85 As Candace Jones et al. describe, the presence of both large and small firms further increases the importance and contribution of a network form of organization:

Power may be constrained in networks owing to complex tasks high in human asset specificity. These tasks demand a high degree of creative problem solving, knowledge, and effort, which are enhanced by a cooperative, rather than adversarial, orientation. Those who are typically seen as powerful—the prime contractors, distributors, or financiers—become dependent on subcontractors to execute their tasks with their best effort and with financial integrity.86

Consistent with the above explanation, networks can be viewed as invoking the image of connectedness between either individuals or organizations.87 The relationships fostered by DARPA can lead to the formation of networks that provide a favorable context for innovation by participants in that network. As Andrew Hargadon and Robert I. Sutton note:

Under conditions of uncertainty, firms seek out partners with technological complementarities. Collaboration can shorten the time it takes to bring new ideas to market, while access to a broad network of cooperative R&D provides companies with a rich portfolio of diverse information sources. Moreover, rather than simply enhancing the transfer of information between two or more parties, the relationship becomes an opportunity for novel syntheses that diverge from the stock of knowledge previously held by the individual. In such circumstances, networks can become the locus of innovation.88

For government employees, participation in innovation networks such as DARPA is an example of the use of an “island/bridge” model, in which innovative groups are relatively isolated from the defense bureaucracy but are allowed direct contact with defense decision-makers and end users.89 DARPA program managers receive a flow of information from the larger research community and match this information to military requirements. They also provide a system-level perspective to researchers focused on specific technologies that will require integration at a higher level to successfully function within an MWS. These program managers also actively orchestrate and continually restructure these networks to encourage new technology development in directions that support DOD goals.90

As explained by Bruce S. Tether and J. Stan Metcalfe, “Innovation systems are not naturally given, they are constructed to solve problems; as they develop, so knowledge and institutions co-evolve.”91 Keith G. Provan and Patrick Kenis suggest that governance of a network like an innovation system “requires frequent reassessment of structural mechanisms and procedures in light of new developments, and a willingness to make needed changes even if they are disruptive.”92 DOD organizational structures, processes, and assignment of responsibilities evolve slowly, which may explain why network structures have proven difficult to formally integrate into the DOD.

Innovation Networks and Industrial Policy

The government agencies that lead an innovation network may have specific, long-term goals that are the result of policy decisions made by elected or appointed officials. These goals should be clearly communicated to current and potential network partners, explaining why participation is worthwhile from their perspective.93 Within the U.S. political system, overt actions that appear to favor specific firms are discouraged, leading to the emergence of what Fred Block has termed a somewhat-hidden “developmental network state.”94

While the United States has a very large defense and technology sector, explicit developmental agendas such as those set by the European Union and its member states are uncommon. However, statements from government officials that the U.S. government does not “do industrial policy” are not consistent with empirical evidence.95 In that context, any major initiative involving the government must maximize funding transparency and minimize rent-seeking behavior.96 Too much visibility of the U.S. government’s role in technology development and innovation could conflict with the dominant discourse of market fundamentalism.97

U.S. government support for technological innovation is fragmented among multiple agencies, and the impact of spending is also dispersed among many large and small firms, universities, and other nonprofit research organizations. An emphasis on smaller firms is appropriate, given that a significant proportion of technological innovation comes from smaller companies that otherwise face significant barriers to doing business with DOD.98 The government may be seen as involved in four distinct but overlapping tasks: targeted resourcing (such as money and people), opening windows (fostering communication among members of a network), brokering, and facilitation.99

Linda Weiss argues that the United States has experienced the emergence of a “hybrid political economy” shaped by a government centered on national security concerns that uses the private sector to maintain American technological dominance.100 She refers to this type of governance, which involves deep integration and interdependence between the public and private sectors, as the “national security state” (NSS), a term that clearly invokes the civil-military fusion concept employed in contemporary China.101 A key part of this approach is avoiding the appearance of overt industrial policy:

By privileging commercial viability in its investment strategies, the NSS has not only extended its technological influence outside the security arena; it has also ventured into economic activities that are more typically associated with the private sector. But by channeling its activities into hybrid structures that merge public and private resources, the breadth and depth of NSS involvement acquire low visibility and high (in other words bipartisan) political appeal.102

Weiss also outlines four mechanisms that the U.S. government uses to compensate for the common short-term orientation of the private sector within the NSS: 1) the freedom of government employees to take a long-term view of investment in innovation; 2) an appetite for risk driven by the goals of technology leadership and military preparedness; 3) the provision of “patient capital” that is risk-tolerant and takes a medium- to long-term perspective; and 4) the cultivation of relational (rather than transactional) capitalism and longer-term supplier relationships. The creation of DARPA and SEMATECH, as well as the Small Business Innovation Research (SBIR) program, are examples of how the government is drawn into economic pursuits that are conventionally viewed as the responsibility of the private sector.103

Relationships within Innovation Networks

The transition from a transactional, or “arm’s length,” relationship between the U.S. government and industry to a relational, or less adversarial, perspective is reflective of an evolution in how interorganizational relationships are characterized. Oliver E. Williamson developed the concept of transaction cost economics (TCE), which explains how organizations determine whether to outsource production (through markets) or carry it out internally (through hierarchies).104 From the TCE perspective, three exchange conditions—uncertainty, asset specificity, and frequency—determine the preferred type of governance.105

The TCE concept is difficult to use, however, for the analysis of relationships that involve more than two entities, such as networks or consortia. Williamson acknowledges that TCE gives network relationships “short shrift.”106 Candace Jones et al. has suggested that TCE can be extended by adding the concepts of social network theory and task complexity, which would support the development of an understanding of what network governance is, where it may occur, and how it can be helpful to firms.107 In making these changes to the original definition of TCE, the authors provide a means of incorporating Williamson’s concept of the frequency of exchanges of information into social network frequency. In this vein, Jones et al. propose the following definition:

Network governance involves a select, persistent, and structured set of autonomous firms (as well as nonprofit agencies) engaged in creating products or services based on implicit and open-ended contracts to adapt to environmental contingencies and to coordinate and safeguard exchanges. These contracts are socially—not legally—binding.108

The DOD has been authorized by Congress to use a somewhat more informal form of contracting called Other Transaction Authorities (OTAs), which are not subject to the detailed requirements of the Federal Acquisition Regulation (FAR). OTAs, and several similar other “non-FAR” authorities, allow for earlier and more informal communication with vendors. This creates a relatively relaxed environment, which is particularly important for smaller firms as well as technology startups that tend to avoid doing business with the military.

Accordingly, the convergence of the military and commercial markets has increased the importance of OTAs.109 However, as a 2020 report by the U.S. House Armed Services Committee notes, OTAs tend to focus on startups, and these firms need to be supported by follow-on business:

When it does support non-traditional companies, the DOD often focuses on early stage investments at the expense of later stage engagement that would allow a company to grow at scale. Often, and for valid reasons, the Pentagon makes a number of small bets on a variety of companies but is seemingly less inclined to wager on nontraditional companies by providing them contracts for programs of record at scale, even when the technology has been validated and fits a military requirement. This reticence makes it more difficult for innovative companies that want to partner with the DOD to obtain private sector funding.

When the Pentagon grants a contract, it signals to other investors that the company is worthy of investment. Without long-term commitment, however, smaller innovative companies with essential technology are often forced away due to the need to demonstrate growth more quickly than the Pentagon can award a contract.110

The DOD has been expanding its use of OTAs, with an increase in obligations from $1.4 billion in 2016 to $11.5 billion in 2021, the latter figure excluding contracts related to COVID-19.111 Rao et al. have suggested that the civilian marketplace now represents a greater threat to the technology supremacy of the U.S. military than any peer competitor.112 After World War II, the DOD occupied the high ground in the key technology areas that were relevant to the military, a situation that is unlikely to recur. The challenge posed by the need to rapidly integrate (“spin-on”) commercial technologies is a significant one. According to Gompert:

Notwithstanding such new contracting alternatives, there remains a major obstacle to spin-on. Simply put, high-tech firms do not want government business. One reason is economic. Say a small venture is awarded an R&D contract and successfully adapts a new technology to meet government needs. When the time arrives for scaling up and generating higher revenues, risk-averse mid-level acquisition officers turn to the LSIs [lead system integrators] on account of their prowess in running large production programmes. This practice strands the firm that developed the technology, or at best forces it to be a subcontractor stuck with diminished profits. Projecting these eventual scenarios for a high-tech firm, venture capitalists would have little incentive to back it. Thus, the firm would have no motivation to pursue federal R&D in the first place.113

In that vein, Rao et al. emphasize that more flexible forms of relationships with the private sector have suffered from a lack of resources and institutional support.114 The interviews conducted by the authors with senior DOD personnel led them to conclude that that innovative contracting methods had created an “alternative universe” that had not been internalized by the organization. This situation has also been described by Flagg and Corrigan as a DOD tendency toward “innovation tourism.”115 These findings suggest that a concerted managerial effort may be needed to make use of non-FAR authorities, as government personnel tend toward risk-averse and compliance-based behavior.116 Horowitz provided some important insights on factors that drive the adoption of innovations, which will be covered later in this article.117

Block et al. point out that TCE tends to underestimate the costs associated with the choice of a hierarchy.118 Internally developed valuations of products transferred within an organization (such as a firm) are generally not as accurate as actual prices set by the market. Moreover, only a few organizations can claim the sophisticated in-house expertise required to decide in each and every case whether to produce internally or outsource.

This lack of current expertise can lead to what Block et al. describe as a risk of “technological stagnation,” and what Robert H. Wade refers to as “group think.”119 Well-established routines can cause organizations to become introspective, limiting their ability to innovate.120 However, as Block et al. note, the networked form of organization also has limitations:

Networked contracting has its own set of costs that can be considerable including the cost of searching for the right network partners. When those search costs are too high, the firm might opt instead for the high transaction costs of traditional contracting or reliance on hierarchy and the risk of technological stagnation.121

Accordingly, Williamson’s markets-or-hierarchies view of organizations has evolved in some cases into a more flexible network environment that allows for both transactional and more socially oriented relationships. In this regard, the case of the United Kingdom is of interest, as described by Arman Avadikyan and Patrick Cohendet:

In the case of the UK defence innovation system, it is clear that the UK authorities, following a liberal perspective, have given priority to the first [transactional] approach according to which the boundaries of the new entities in the system are supposed to be shaped by the transactional criteria. However, as emphasised in pervious sections, the requirements of the economics of knowledge have played the role of a return spring that calls for a questioning and a reconsideration of the governance structures inspired by a pure transactional approach. Step by step, a real hybrid governance structure has been implemented, which is characterised in particular by numerous evolving networks and cognitive platforms associating private and public actors.122

The “hybrid governance structure” referred to here also generally characterizes the DIS construct in the United States. The networks that make up DIS are an essential tool in tackling the increasing pace of weapon systems development by competitors such as China. However, one further issue that needs to be appreciated about these networks is what makes the users in their constituent organizations more or less “venturesome” in their behavior.123 How aggressive users are in demanding and adopting innovations is a critical factor driving the pace of innovation system evolution.

Factors Affecting Innovation Adoption and Venturesomeness of Military Organizations

To develop a complete picture of the innovation outcomes that the U.S. military actually achieves, one must understand both the DIS it is embedded in and its own innovation adoption behaviors. What actually gets adopted by a DOD entity depends on both the available innovations and whether the DOD exploits those innovations. The adoption behaviors of the DOD—which can be summarized in terms of how venturesome the U.S. military departments are in exploiting innovations—are therefore a critically important influence on how U.S. DIS perform. One reason for this influence is that the behavior of networks created by participants in different subsectors of DIS is informed not just by DOD R&D spending but also by the participants’ expectations about what innovations the U.S. military will adopt and at what scale.

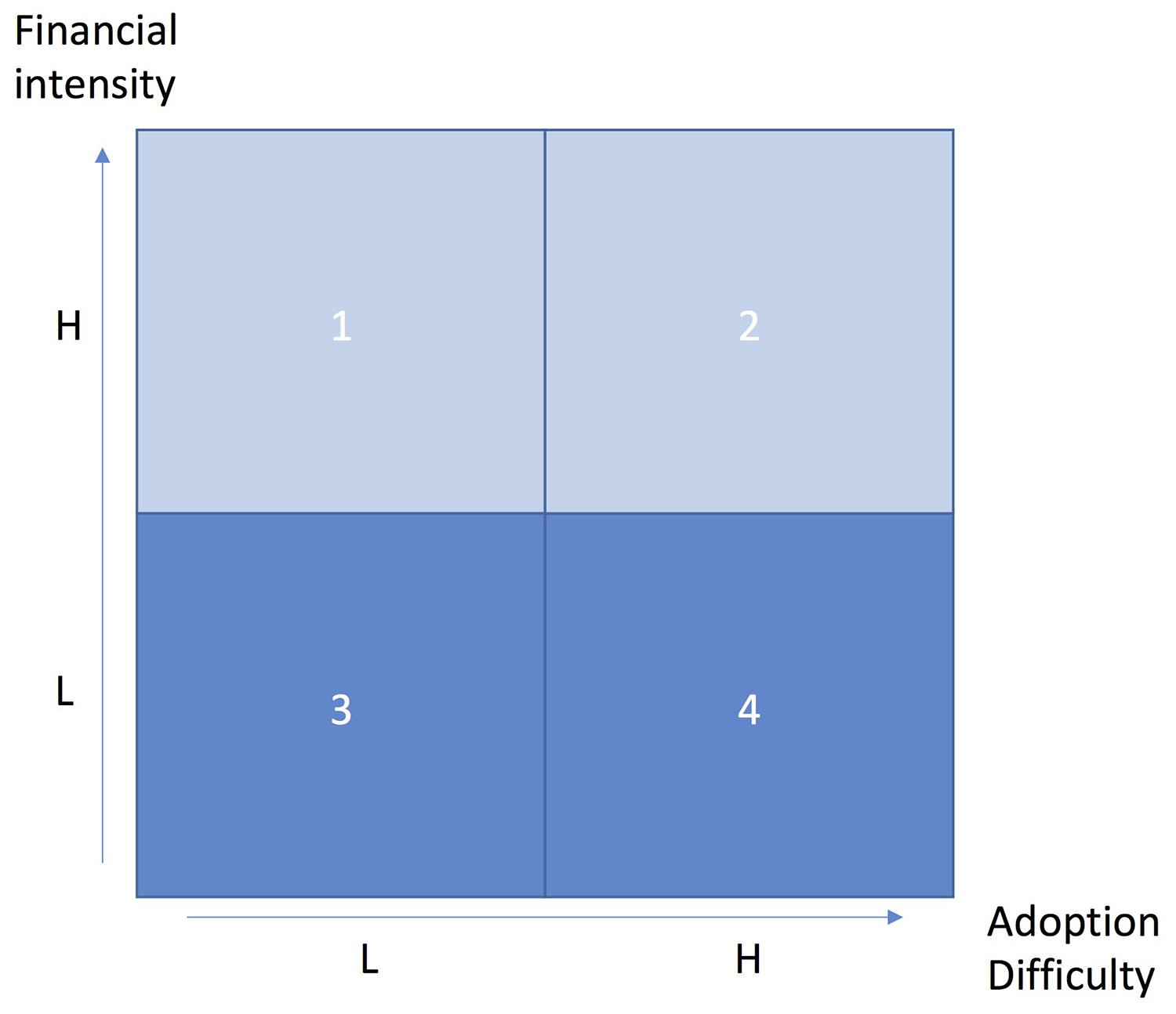

Horowitz proposes that the adoption of military innovation depends on two broad factors: first, the military’s financial capacity (e.g., to fund R&D, initial procurement, and the full lifecycle costs of the program); and second, the organizational capacity to absorb the innovation.124 This leads to the following diagram:

Figure 1. Factors in the adoption of military innovation

Source: adapted from Michael C. Horowitz, The Diffusion of Military Power: Causes and Consequences for International Politics (Princeton, NJ: Princeton University Press, 2010), 33.

In this diagram, quadrants 1 and 2 are comprised of MWS. For the United States, this is the province of the largest acquisition programs that typically have service lifetimes stretching multiple decades, such as ships, missiles, or aircraft. These two quadrants also represent the innovation system that often first comes to mind at the mention of “defense innovation system.” The difference between quadrant 1 and 2 is in the organizational capacity required to adopt these weapons systems. Nuclear and biological weapons are examples in which the systems required high financial capacity to develop and field but placed a low burden on organization adoption capacity because they largely fit in with preexisting ways that militaries wage war. These are quadrant 1 systems.

Quadrant 2 is comprised of MWS that are more difficult to adopt. Aircraft carrier warfare is the quintessential example of the twentieth century because carriers are both a huge financial burden and organizationally difficult to implement. The entire cost of a carrier strike group includes not only the carrier but also all the aircraft flying from it during its lifetime, plus the supporting vessels that protect the carrier and comprise the balance of a strike group. This is a financial burden that is much larger than just the carrier itself. In addition, carrier operations are organizationally difficult to master, requiring substantial (and costly) training and learning from experience (e.g., the routine loss of carrier-borne aircraft that subsequently need replacing).

The MWS in quadrants 1 and 2 are highly defense-specific innovations and are almost exclusively the territory of major defense contractors, which in the United States comprise the Big Six. Other countries may have perhaps only one national champion with significant capabilities in aircraft, shipbuilding, or ground equipment.

For some very long-life systems, most of the financial cost is ultimately in maintenance and upgrade programs (e.g., block upgrades), which makes lifecycle management of these programs an important aspect of the relevant innovation systems and makes long-term government support of these innovation systems inevitable for decades. Among the United States and its allies, the F-35 program is arguably the best current example, with early examples already subject to an expensive upgrade process.

The financial support and downstream adoption capacity of the U.S. military Services are typically the binding constraints on how fast the MWS innovation system can evolve (i.e., these subsystems are closely coupled with DOD willingness to input resources and ability to adopt MWS outputs).

Quadrants 3 and 4 are the province of DUT that generally is not as financially burdensome as MWS. Importantly, innovations in these quadrants are frequently not specific to defense, varying in the degree to which they are packaged and tailored specifically to DOD requirements. For example, the Oshkosh Defense Joint Light Tactical Vehicle (JLTV) that replaces the High Mobility Multipurpose Wheeled Vehicle (HMMWV, or Humvee) uses a commercial drivetrain (a General Motors engine and Allison gearbox from a mass-produced pickup truck) and hundreds of other COTS components. Another subsystem is small arms, which is fundamentally a mature technology available from a wide number of sources globally and overlaps with commercial small arms sales. For instance, the U.S. Army historically bought sidearms from Beretta in Italy until switching in 2017 to SIG Sauer in Germany.

Information technology and information systems (IT/IS) represent a third subsector in which commercial innovations are pace setting. Examples of such innovations include electronics components (hardware) and cutting-edge AI (software) that are fast evolving.125 In fact, some analysts have argued that the U.S. government is barely keeping up with the rapid clip of commercial innovation in some areas of IT/IS that increasingly consists of DUT that is crucial for national security.126

Quadrant 3 innovations have lower financial intensity and a lower requirement for organizational skills to adopt them. These innovations therefore diffuse more rapidly both within the DOD and to international competitors. These adoption characteristics have important implications for the pace at which the upstream innovation system can evolve. When civilian versions of DUT are being adopted in the private and public sectors, the DOD’s adoption capacity is not the binding constraint on innovation in this quadrant. Instead, the private sector or international rivals set the pace of learning and evolution that is possible in specific DUT subsystems. Neither is DOD R&D support a binding constraint in these subsystems, since most supplier decisions to fund their own R&D are based on expected commercial outcomes. This makes the R&D trajectory in most DUT systems independent of DOD requirements.

Quadrant 4 differs from quadrant 3 in that innovations in this quadrant require large amounts of organizational capacity to be implemented even though they are less financially burdensome. Horowitz suggests the military method of blitzkrieg as a prime example, since mastering this style of warfare required significant organizational and doctrine changes but not the introduction of major new weapons systems, per se.127 This article will mostly discuss quadrant 3 innovations, since they set the pace of evolution for DUT innovation systems.

In sum, this diagram indicates that segmenting the DIS construct by downstream innovation adoption behavior is important for understanding the influences on DIS subsystems. As an analytic construct, innovation systems amalgamate both upstream and downstream elements, placing the emphasis on the networks of organizations that coordinate activities. Factors such as the flow of information in networks, the degree of interaction between producers and users, the venturesomeness of users, and the pace of innovation adoption are endogenous to innovation systems and therefore help drive the behavior of these systems.

For U.S. DIS, this results in two distinct subsystems that behave in very different ways. The first is organized around MWS and supplied largely by the Big Six who, in turn, rely on a constellation of subcontractors. The second is organized around DUT supplied by thousands of suppliers whose business is not primarily—and sometimes only very peripherally—in defense. The important outcome observed here is that these subsystems are evolving very differently in terms of speed. This article will turn to this issue next, where the authors will also leverage the background research above to explain the performance of U.S. DIS in terms of the speed of evolution.

Analyzing the U.S. Defense Innovation System

Evolution of the MWS Innovation System

The DOD, through its requirement for weapon systems, is heavily dependent on the Big Six defense contractors (as well as a large number of smaller firms) for building and maintaining its MWS. However, many casual onlookers are not aware of the full extent to which this relationship is interdependent. For MWS, the DOD does not simply contract with suppliers for the delivery of turnkey products. Instead, DOD program management offices (e.g., the F-35 Joint Program Office) run the programs, operating as focal points of innovation subsystems that elements of the Big Six participate in. Each of the Big Six can be thought of as a system that is made up of numerous smaller subsystems (e.g., individual business units, often a particular product office) that DOD elements interact with. There is value in analyzing these subelements that populate DIS rather than assuming Boeing or Northrop Grumman as a whole. In many instances, a quick review of the innovation systems shows a myriad of network connections and joint ventures between subelements of different firms that suggests that these firms are not at all solely in competition with one another in the sense that orthodox economics might emphasize. Instead, they compete and collaborate simultaneously based on multiple positions within particular innovation subsystems.

Analytically, seeing the individual business units of the Big Six helps overcome an important bias in some studies of defense innovation: the tendency to assume that the size of the Big Six alone is bad for the pace of U.S. military innovation. This assumption is based on the notion that small entrepreneurial firms are inherently more innovative than large firms. It leads to the suggestion that the DOD can improve its innovation performance simply by doing more business with small firms.128 However, this image is not entirely accurate. Across all industries, innovation actually slightly increases with firm size (the size of this effect, however, is small, implying that innovation simply does not vary much with firm size).129 An alternative explanation is that the DOD bureaucracy may be the key drag on U.S. military innovation, rather than the firms, large or small, that interact with it.

Moreover, as has already been emphasized, an innovation systems analysis illustrates that DOD elements work at an operational level with elements of the Big Six rather than with the corporate entities themselves, which further undermines any supposed link between the size of the major contractors and the pace of innovation. Overall, the evidence suggests that whatever is driving the slow rate of innovation in MWS, it is unlikely to be corporate size itself. It is the view of the authors that there is not enough emphasis in the DOD bureaucracy on how the DOD can make the big defense contractors part of the solution to speeding up innovation.

Another criticism of the Big Six is that they are deficient in proactively innovating.130 However, this view overlooks how R&D for MWS is funded, which is less a function of the behavior of the Big Six and more a function of the institutional organization of the United States’ DIS. The major defense contractors do everything based on DOD demand, including innovation, whether that takes the form of product R&D or manufacturing process innovation. Unlike the DUT innovation system, there is little or no demand signal for speculative innovation in MWS to be pushed up from the supply side.131 As Stephen P. Rodriguez, founding partner of One Defense, puts it:

The Big 6 contractors are amazing at scale. They can execute massive programs at scale in the way that very few companies in the world [are able to], and to their everlasting credit, they need to be enabled and supported to do so. But they don’t innovate on their own. The main reason why they don’t do that is the government isn’t shifting its requirements. So they’re saying: why would I ever just develop something on my own without the government asking for it to begin with?132

Rodriguez’s comment highlights an important fact: that R&D in the MWS subsystem is driven tightly by what the DOD is willing to fund. In the long run, the Big Six have not been R&D constrained, as the Pentagon has generously funded very significant R&D in many areas for decades, to include radar, stealth, advanced electronics, and more. The pertinent observation is that the institutional structure of MWS procurement does not support speculative R&D. Therefore, the MWS innovation system is not going to behave in the same way as DUT systems, in which producers fund their own R&D based on expectations about user demand. The traditional tools of DOD R&D contracting simply do not support speculative R&D by defense contractors.

One advantage of direct DOD sponsorship of R&D is the variety of ways in which the DOD uses the visible hand to organize and coordinate R&D spending. Replacing the invisible hand of the market with the visible hand of managerial coordination was a major theme of research that laid the foundations of corporate strategy, as detailed in Alfred D. Chandler Jr.’s Strategy and Structure: Chapters in the History of the American Industrial Empire. Chandler highlighted the significant role of the visible hand of management in developing innovation capabilities inside the corporation.133 According to one reviewer, “The mistaken notion that economic efficiency was substantially independent of internal organization was no longer tenable after the book appeared.”134 However, many of the same lessons apply to managing innovation systems, with networks being the principal mechanism for organizing interventions by the visible hand.135

Here, coordination of R&D occurs in two ways. First, there is coordination across the varied organizations in particular innovation systems in order to produce R&D outcomes that complement each other and are timed with each other. As Mazzucato has highlighted, the DOD has been adept at managing some extremely sophisticated development programs with many R&D elements that needed to arrive on time in order for the final system to be manufactured.136 The DOD thereby escapes some of the worst coordination failures that market-based R&D processes are vulnerable to when producers are unable to coordinate their mutual expectations about one another’s R&D efforts.137 These would normally result in underinvestment in R&D, to the detriment of speed of advancement of the overall innovation system. A strong dose of the visible hand, in the form of organizational networking, is a key DOD mechanism for averting this problem.

A second form of coordination is between R&D and end-user demand. The DOD is able to coordinate its R&D spending on the basis of its own concentrated pool of demand, which results in relatively efficient demand pull-through of innovations.138 Commercial market processes can also be effective at directing R&D to the creation of new products. However, there is no doubt that market processes typically create a lot of R&D waste by speculatively exploring areas of demand that fail to transpire. Numerous studies show the vast majority of new commercial products—likely more than 90 percent—fail in the marketplace.139 While the DOD has its own sources of waste, it also has strong incentives to spend its R&D budget wisely on systems that it actually expects it needs in the future. Therefore, for MWS, the DOD’s direct coordination of R&D helps reduce spending of scarce R&D dollars on systems that the DOD has no intention of fielding.

It is worth remembering that MWS serve both as focal points for innovation, which in theory makes them a coordination point and accelerant of innovation, as well as constraints on the pace of innovation.140 The latter effect arises because the coordination of routines between DOD entities and Big Six entities lock in both sides to the other’s ways of doing things. Take, for example, maintenance practices for a major program such as U.S. Navy ships. Not only are the Big Six in many cases the only players with the required capabilities to perform certain kinds of work, but how the DOD contracts ship repair work systematically affects contractors’ abilities to get the work done on the Navy’s timeline. The Navy and its major contractors therefore coproduce ship maintenance services, operating jointly using routines that have co-evolved for dealing with a mutual task. As Karina M. Fernando notes, the Big Six and smaller DOD prime contractors also have to maintain their own long-term viability:

The [DOD’s] defense strategies to outpace global rivals . . . demand that defense contractors develop products and technologies for the [DOD] to assert its superiority. Defense contractors must therefore raise and deploy capital towards research, investments, and production of technically sophisticated defense products. Specific defense requirements also entail contractors to face trade-offs in deciding what to feasibly pursue, from a range of products and services or a shift between defense and commercial business. In the example of a new weapon system build, defense contractors must make capital investments to create a prototypical design in hopes of winning a contract. Those who lose contracts face sunk costs from capital outlays on the prototype. Those who are awarded contracts must make additional investments towards production, which is possibly limited by the project’s funding levels. The customization level for this weapon system also means that production capability may not be immediately scalable to other defense or commercial projects. These contractors face potentially large sunk costs for a relatively small production run of a highly sophisticated system.141

When delays arise, they are sometimes “both-sides problems,” with DOD contracting practices just as much to blame as contractors for creating a suboptimal system.142 In turn, those contracting practices may not follow actual DOD policy (known as “policy without practice”) and may be fueled by soft factors such as a lack of trust between the DOD and major contractors.143 For example, speeding up ship repair timelines depends on the DOD fixing its own routines for coordinating with contractors or fixing suboptimal relationships with contractors.144

While bureaucratic constraints do exist among the Big Six, given the DOD’s byzantine bureaucratic routines, it is likely that the binding constraint typically lies on the DOD side. Therefore, a key pathway for accelerating innovation in MWS remains improvements in DOD bureaucratic processes that currently limit the velocity of the overall system.145 Anecdotal evidence suggests that such improvement is possible—for example, the United Kingdom, France, and Japan appear to have much more productive relationships with their major defense contractors.146

Regardless of upstream inputs to R&D and manufacturing, any innovation system is ultimately constrained by the adoption rate of innovations. DOD adoption dynamics are therefore an especially important factor that paces the overall MWS innovation system by pacing the portfolio of subsystems. One past chairman of the Defense Innovation Board, Eric Schmidt, stated that the DOD “doesn’t have an innovation problem; it has an innovation adoption problem.”147 The point is that the binding constraint on innovation does not lay with producers in the DIS but rather with the users of the system.

Horowitz’s analysis of military innovation adoption highlights that adoption varies in difficulty for militaries depending on certain general characteristics.148 Those characteristics vary across countries, so what is difficult for one country’s military may not be difficult for another’s. Horowitz claims that this depends on multiple variables, such as the age of a military department. In a complementary analysis, Dima Adamsky claims that broader national cultural factors also impact the willingness or reluctance of a country’s military to adopt specific innovations.149 Therefore, there is meaningful variation in the underlying adoption skills of defense organizations.

Stephen Peter Rosen proposes that internal dynamics in the officer corps also play a role in innovation adoption.150 For example, the U.S. Air Force may be reluctant to adopt unmanned aerial systems (UAS) because its senior ranks are dominated by fighter pilots who tend to see UAS as a threat to the professional community they cherish. However, the Iranian air force may have no such constraints owing to its dilapidated fleet of fighters; nor may ISIS, precisely because it does not have an air force. This means UAS are seen as an opportunity rather than a threat.

By their very nature, MWS tend to create long-lived stakeholder groups with incentives to resist changes to the status quo of these programs. These groups tend to favor incremental innovations such as block upgrade programs that extend the service life of specific MWS and extra orders for that MWS, which partly explains why MWS develop innovation subsystems that stay in place and slowly evolve over many decades. The U.S. Navy’s Boeing F/A-18 Super Hornet and the U.S. Air Force’s Fairchild Republic A-10 Thunderbolt II (Warthog) programs both serve as exemplars among innumerable other U.S. systems. The same groups have incentives to strongly resist innovations that threaten to substitute or divert funding from the MWS they have a stake in. User rejection of replacement innovations is one key mechanism of resistance. Firsthand accounts of Pentagon bureaucratic politics, such as by former Secretary of Defense Robert M. Gates, have consistently stressed the extent to which the individual military Services will go to keep the budgets for their own MWS intact, emphasizing the role that Congress plays in fortifying the Services’ bargaining position.151

In sum, the stance that specific DOD elements take on innovation adoption is an important factor in the behavior of the MWS innovation system. All other things being equal, these factors tend to slow down the evolution of the MWS innovation system.

New entrants are a final element that affect the speed of evolution of the MWS innovation system. New entrants can be categorized into two distinct groups: domestic edge players that act as subcontractors for the Big Six; and major foreign firms that compete with the Big Six. The first category of edge players comprises the constellation of subcontractors that the Big Six depend on for defense-specific products and services. These organizations also form part of the overall defense innovation system, and it would be wrong to think that they are static. The portfolio of subcontractors working for the Big Six changes over time, such as when block upgrades introduce new technologies into an MWS. Consequently, the evolution of subsystems occurs partly via the introduction of new fringe players, often as MWS subcontractors, since this is one of the major ways of introducing new capabilities into MWS.152

Another group of new entrants are major defense contractors from allied countries. While the DOD has historically dealt with non-U.S. defense majors on a very limited basis, the scale of non-U.S. majors has been growing in recent years and has the potential to significantly impact some DIS subsystems. One long-running example is BAE, which was a significant contractor on the AV-8B Harrier jump-jet program for the U.S. Marine Corps beginning in the 1970s, as was mentioned earlier in this article. BAE has major workshare in the development and production of the F-35 Lightning II and works as a major contractor on several other DOD programs. BAE also has significant facilities in the United States.153

The emergence of the Airbus aerospace company is another case in point. Airbus provided significant competition for the U.S. Air Force refueling aircraft program, at one point winning the prime contract with its A330 Multirole Tanker Transport (MRTT), only to see that award overturned in favor of Boeing’s KC-46A Pegasus aerial refueling and transport aircraft. However, Air Force leadership has grown frustrated with the significant delays and subsystem problems of the KC-46A and have decided to purchase the MRTT in addition to the KC-46A.154 The Airbus A400M Atlas airlifter is currently in use by eight countries as a successor to the Lockheed Martin C-130 Hercules transport aircraft.155 As was mentioned earlier, Airbus also builds helicopters for the U.S. Army in Mississippi. With programs such as these, Airbus may be poised to become a significant influencer in American DIS.