Professor Bert Chapman

https://doi.org/10.21140/mcuj.20251601003

PRINTER FRIENDLY PDF

EPUB

AUDIOBOOK

Abstract: Critical and strategic minerals have become increasingly important in U.S. government civilian and military policymaking in recent years. This is demonstrated by the heavy use of such minerals in many critical civilian and military infrastructures. This work will discuss how this subject has been addressed in laws, presidential documents, and works by government agencies along with congressional oversight committees and support agencies. It will stress how the United States is heavily dependent on strategic minerals from adversarial foreign countries such as China and will examine U.S. efforts to increase its ability to produce such materials in the United States by reforming permitting processes. It will conclude with recommendations for the United States to enhance its ability to produce these materials domestically and acquire them from reliable foreign sources. The conclusion will also suggest ways that the president and federal agency stakeholders can enhance public awareness of this problem and their efforts to rectify it.

Keywords: strategic minerals, supply chain, national security, technology, permitting, congressional oversight, government information, military information

Critical and strategic materials are vital for technologies used across the economy in electronics, energy, defense, and health care. U.S. supply of these commodities is highly dependent on foreign countries as demonstrated in figure 1.

Figure 1. The 2022 U.S. list of critical minerals, percentage of the U.S. supply imported in 2022, industries in which each is used, and primary import source

Source: Mineral Commodity Summaries 2023 (Reston, VA: U.S. Geological Survey, 2023); provides exhaustive enumeration of domestic and international reserves of these minerals; and Technology Assessment Critical Minerals: Status, Challenge, and Policy Options for Recovery from Nontraditional Sources (Washington, DC: Government Accountability Office, 2024), 4.

Minerals are essential for manufacturing defense goods including bombers, missiles, submarines, and torpedoes. Access to secure mineral supplies significantly influences a nation-state’s military capabilities with their possession of substantial, secure mineral supplies that enable considerable mineral power. When mineral power and ensuing military might reach significant levels, it is possible for states to achieve great power status internationally and exert significant influence on security-related topics. Powerful countries have always depended on possessing healthy mineral resource supplies.1

This work strives to document recent U.S. government policy literature on this subject and concludes with recommendations for the United States to enhance its domestic production and processing capabilities for these commodities to decrease its reliance on unstable and potentially adversarial supply chain providers.

A 2024 Congressional Research Service analysis emphasized the importance of critical and strategic minerals as being essential for specific products and services and subject to supply risks. It maintained gallium, germanium, and silicon are critical for manufacturing semiconductors. Lithium, cobalt, and nickel are essential for batteries in electric vehicles and other products. Some rare earth elements are required for manufacturing touchscreens in electronic products and magnet-based motors driving large wind turbines and electric vehicles. Demand for these products is expected to increase in the following decade.2

First and Second Trump Administration and Biden Administration Documents

Critical and strategic mineral policy literature encompasses multiple presidential administrations and these terms have different meanings depending on what U.S. government department describes them and depending on definitions in U.S. statutory law. Concerns about the U.S. relationship and policies with critical and strategic minerals has significant historical provenance. In 2008, two National Academies reports documented such concerns. A 2008 report on these commodities and the U.S. economy concluded that a critical mineral is essential in use and subject to supply restriction, its criticality can change as production technologies evolve and new products are developed, and the larger the difficulty, time, and expense it takes for a material substitution to occur the more critical a mineral becomes to a specific application or project. Report recommendations include the federal government needing to enhance the types of data and information it analyzes, collects, and disseminates on these minerals and products with particular emphasis on products that may become critical; the U.S. Geological Survey (USGS) Minerals Information Team requiring greater authority and autonomy to communicate with governmental and nongovernmental organizations about their mineral findings; and other federal agencies needing to develop and fund activities to encourage U.S. innovation in critical minerals and materials.3

A second National Academies report that year on materials management for a twenty-first century military documented global defense production, stockpiling, and supply chain practices of the United States and other countries. It stressed a continuing need for a U.S. National Defense Stockpile (NDS) to store materials critical to U.S. national defense but that its current design, operation, and structure made it ineffective in responding to emerging needs and threats and that insufficient quality data and information from domestic and offshore sources on materials availability restricts effective management of defense critical supply chains. Report recommendations included: the Department of Defense (DOD) establishing a new system to manage supply of these materials; an ongoing analytical process to identify critical materials for defense systems; establishing tools to support and stabilize robust supply chains; partnering with private industry and considering options for outsourcing and off-shoring; and providing proper and robust information systems and forecasting tools.4

Executive Order (EO) 13817, A Federal Strategy To Ensure Secure and Reliable Supplies of Critical Minerals, issued on 20 December 2017, saw President Donald J. Trump contend that the United States was heavily dependent on importing mineral commodities vital to national security and economic prosperity. Such foreign source dependence makes the United States vulnerable to adverse foreign government action, natural disaster, and other events capable of disrupting supply of these materials. This document noted that the Department of the Interior defined critical mineral as a nonfuel mineral or mineral material essential to U.S. economic and national security, has a supply chain vulnerable to disruption, and serves an essential function in product manufacturing and the absence of this commodity would have significant economic and national security consequences. This document directed the U.S. government to identify new sources of critical minerals, increase activity at all supply chain levels including exploration, mining, concentration, separation, alloying, recycling, and reprocessing critical minerals; ensuring U.S. miners and producers have electronic access to the most advanced topographic, geologic, and geophysical data in U.S. territory; and streamlining leasing and permitting processes to expedite exploration, production, processing, recycling, and domestic refining and critical minerals.5

EO 13953, Addressing the Threat to the Domestic Supply Chain from Reliance on Critical Minerals from Foreign Adversaries and Supporting the Domestic Mining and Processing Industries, issued on 30 September 2020, saw Trump highlight the threats of heavy U.S. dependence on China demonstrated by the United States importing 80 percent of rare earth elements from China. This document also noted assertive Chinese policies to strategically flood the global market with these commodities and displace competitors. It determined that the United States must enhance its mining and processing capacity for all minerals and directed various cabinet departments to prepare a report to recommend executive action against China and nonmarket foreign adversaries including imposing tariffs and quotas and other import restrictions.6

A 2019 Commerce Department assessment produced during the first Trump administration noted that the United States imports most critical mineral commodities with 31 of 35 minerals designated critical by the Interior Department and that the U.S. imports of these minerals represent greater than 50 percent of annual consumption. This assessment also observed that the United States does not have any domestic production and relies exclusively on imports to supply 14 critical minerals.7

Significant legal emphasis was placed on critical minerals in the Energy Act provisions of the 2021 Consolidated Appropriations Act. This statute directed the Department of Energy (DOE) to research advanced separation technologies to extract and recover rare earth elements and other critical materials from coal and its products while determining possible mitigation of potential environmental or public health impacts from recovering rare earth elements from coal-based resources. Section 7002 of this statute defined critical materials and minerals as any nonfuel mineral, element, substance, or material with a high risk of supply chain disruption and serving an essential function in one of more energy technologies including those producing, transmitting, storing, and conserving energy. It went on to define critical minerals as “any mineral, element, substance, or material designated as critical by the Secretary of the Interior, acting through the director of the U.S. Geological Survey (USGS).”8

This statute also directed the Interior Department to produce a comprehensive national assessment of each critical mineral, identifying and quantifying known critical mineral resources and providing a qualitative and quantitative assessment of uncovered U.S. critical mineral resources including probability grade and tonnage estimates within four years.9

Figure 2 shows how the top producers and refiners of critical minerals for battery refining and mining is globally dispersed with some of these activities occurring in adversarial countries such as China and Russia.

Figure 2. Top four producers of highest risk battery materials for mining and refining stages

Source: Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-based Growth: 100-Day Reviews under Executive Order 14017 (Washington, DC: White House, 2021).

On 24 February 2021 President Joseph R. Biden issued Executive Order 14017, America’s Supply Chains. This document directed the National Security Council (NSC) and the assistant to the president for economic policy (ASEP) to coordinate executive branch actions by preparing a 100-day supply chain review involving the Commerce, Defense, Energy, and other departments. The Commerce and Energy Departments were directed to identify supply chain risks in semiconductor management, advanced packaging, and high-capacity batteries including electric vehicle batteries. Defense was directed to identify critical mineral supply chain risks including rare earth elements and strategic minerals as well as policy recommendations addressing these risks.10

The report mandated by this EO was released in June 2021. Recommendations for the Commerce Department stressed increasing its partnership with industry on semiconductors to enhance information flow between semiconductor suppliers and end users; strengthening engagement with allies and partners to promote fair semiconductor chip allocations, increasing production, and encouraging increased investment; advancing adoption of effective supply chain management and security practices; strengthening the defense semiconductor manufacturing ecosystem; providing focused support for domestic national security related chip production; and engaging with allies and partners on semiconductor supply chain resilience.11

Recommendations for the Department of Defense included developing and fostering new sustainability standards for strategic and critical material intensive industries; expanding sustainable domestic production and processing capacity, including recovery from secondary and unconventional sources and recycling; deploying the Defense Production Act (DPA) and other programs to issue grants, loans, loan guarantees, and economic incentives to establish industrial capacity, subsidize markets, and acquire materials; using DPA to mitigate current or anticipated national defense shortfalls; convening industry stakeholders to expand production; promoting interagency research and development to support sustainable production and technically skilled workers; strengthening U.S. stockpiles under the 1939 Strategic and Critical Materials Stock Piling Act; and working with allies and partners to increase global supply chain transparency.12

Report recommendations for the Energy Department include stimulating demand for end use products using domestically manufactured high capacity batteries; supporting demand for batteries in the transportation sector; electrifying federal, state, local, and tribal government fleets; strengthening responsibly sourced supplies for key advanced battery minerals with many of these minerals coming from troubled countries like the Democratic Republic of Congo, which possesses approximately 80 percent of global cobalt reserves, and adversarial countries like China; supporting sustainable lithium domestic extraction and refining from existing sources in Arkansas, California, Nevada, and North Carolina; modernizing laws and regulations governing mining on public lands with lithium in California and Nevada; investing in nickel refining coordination with allies; identifying opportunities for supporting sustainable cobalt production and refining; and working with partners and allies to expand global production and supply access.13

On 31 March 2022, President Biden issued a memorandum for the secretary of defense directing this official to secure a reliable and sustainable supply of domestic and critical materials. Provisions within this document included:

(1) sustainable and responsible domestic mining, beneficiation, and value-added processing of strategic and critical materials for the production of large-capacity batteries for the automotive, e-mobility, and stationary storage sectors are essential to the national defense;

(2) without Presidential action under section 303 of the Act, U.S. industry cannot reasonably be expected to provide the capability for these needed industrial resources, materials, or critical technology items in a timely manner; and

(3) purchases, purchase commitments, or other action pursuant to section 303 of the Act are the most cost-effective, expedient, and practical alternative method for meeting the need.

(b) Consistent with section 303(a)(1) of the Act, the Secretary of Defense shall create, maintain, protect, expand, or restore sustainable and responsible domestic production capabilities of such strategic and critical materials by supporting feasibility studies for mature mining, beneficiation, and value-added processing projects; by-product and co-product production at existing mining, mine waste reclamation, and other industrial facilities; mining, beneficiation, and value-added processing modernization to increase productivity, environmental sustainability, and workforce safety; and any other such activities authorized under section 303(a)(1) of the Act.14

The January 2025 onset of the second Trump administration saw resumed presidential emphasis on critical and strategic minerals. EO 14154, Unleashing American Energy, issued on 20 January 2025, declared a national energy emergency and sought to establish the United States and the world’s leading producer and processor of nonfuel materials including rare earth minerals, which this document contended would create domestic jobs and prosperity, strengthen U.S. and allied supply chains, and reduce the global influence of adversarial states. It directed federal agencies to reduce undue burdens on the domestic mining and processing of nonfuel minerals, update the USGS list of critical minerals and potentially add uranium to that list; map previously unknown critical mineral deposits; assess whether imported critical minerals were produced by forced labor; and ensure that the National Defense Stockpile has a robust supply of critical minerals if a future shortfall occurs.15

On 20 March 20, 2025, EO 14241, Immediate Measures to Increase American Mineral Production, directed immediate measures to increase U.S. mineral production. Within 10–30 days, it directed the heads of U.S. agencies involved in minerals permitting to give to Interior Secretary Doug Burgum, the head of the National Energy Dominance Council (NEDC), any permits that can immediately be approved or permits that can be immediately issued. Industry feedback on this matter is to be solicited and the interior secretary will prioritize mineral production and mining related purposes as primary land uses in these areas consistent with applicable law. The Department of Defense (DOD) was authorized to make mineral production a priority industrial capability development area for the Industrial Base Analysis and Sustainment Program.16

The previously mentioned 2019 Commerce Department assessment produced during the first Trump administration observed that the United States does not have any domestic production and relies exclusively on imports to supply 14 critical minerals. Recommendations from this assessment include:

• Advance transformational research, development, and deployment across critical mineral supply chains: Assess progress toward critical minerals recycling and reprocessing technologies, technological alternatives to critical minerals, source diversification, and improving processes for critical mineral extraction, separation, purification, and alloying.

• Strengthen America’s critical mineral supply chain and defense industrial base: Discuss ways to improve critical mineral supply chains, which could help reduce risks to U.S. supply by increasing domestic critical mineral resource development, building robust downstream manufacturing capabilities, and ensuring sufficient productive capacity.

• Enhance international trade and cooperation related to critical minerals: Identifying options for accessing and developing critical minerals through investment and trade with America’s allies, discussing areas for international collaboration and cooperation, and ensuring robust enforcement of U.S. trade laws and international agreements that help address adverse impacts of market-distorting foreign direct trade conduct.

• Improve understanding of domestic critical mineral resources: Provide a plan to improve and publicize the topographical, geological, geophysical, and bathymetrical mapping of the United States; support mineral collection and analysis of commodity-specific mitigation strategies; and conduct critical mineral resource assessments to support domestic mineral exploration and development of conventional sources.

• Improve access to domestic critical mineral resources on federal lands and reduce permitting timeframes: Provide recommendations to streamline permitting and review processes related to developing mining claims or leases and enhancing access to domestic critical mineral resources.

• Grow the American critical minerals workforce: Determine activities required to develop and maintain a strong domestic workforce, fostering a robust domestic industrial base.17

Department of Defense

On 8 June 2021, the DOD defined strategic critical minerals as “those that support military and essential civilian industry; and are not found or produced in the United States in quantities to meet our needs.”18 The Defense Logistics Agency (DLA) serves as the key agency for analyzing, planning, purchasing, and managing materials critical to national security. DLA works with clients by demonstrating technical expertise, global/geopolitical material supply analysis, and managing and tracking multiple existing and future critical materials. Its mission includes:

• Operating and overseeing the National Defense Stockpile (NPS);

• Acquiring and retaining stockpile materials;

• Converting and upgrading stockpile materials to prevent obsolescence;

• Developing and qualifying domestic strategic mineral sources;

• Recycling strategic materials from end of life government items; and

• Disposing excess stocks for operational funding.19

DLA stores multiple commodities at various U.S. locations (table 1).

Table 1. DLA depot commodities

|

Hammond, IN

|

Beryllium Metal, Chromium Metal, Low and High Carbon Ferrochromium, Tungsten O&C, Tin

|

|

Lordstown, OH

|

None

|

|

Point Pleasant, WV

|

Ferromanganese, Low Carbon Ferrochromium

|

|

Scotia, NY

|

Low Carbon Ferrochromium, Electrolytic Chromium Metal, Tungsten O&C, Zinc

|

|

Wenden, AZ

|

Manganese ore

|

Source: “About Strategic Minerals,” Defense Logistics Agency, accessed 12 November 2024; and Depot Information (Fort Belvoir, VA: DLA, 2024): 1.

On 1 October 2024, DLA issued its Annual Material Plan (AMP) of anticipated potential/sales and disposals and acquisition of new defense stocks (NDS) for fiscal year (FY) 2025 between 1 October 2024 and 30 September 2025 (tables 2 and 3).20

Table 2. Defense Logistics Agency’s annual materials plan for FY 2024

|

Material

|

Unit

|

Ceiling quantity

|

|

Aluminum high purity

|

MT (metric ton)

|

1,700

|

|

Aluminum alloys

|

MT

|

1,500

|

|

Antimony

|

MT

|

700

|

|

Cadmium zinc telluride

|

EA (environmental assessment)

|

2,800

|

|

Electrolytic manganese metal

|

MT

|

5,000

|

|

Energetics

|

LBS (pounds)

|

20,000,000

|

|

Ferroniobium

|

LBS nb

|

300,000

|

|

Grain-oriented electrical steel

|

MT

|

3,200

|

|

Hafnium

|

MT

|

2,300

|

|

Iso-molded graphite

|

MT

|

1,700

|

|

Lanthanum

|

MT

|

1,100

|

|

Magnesium

|

MT

|

3,500

|

|

Neodymium-praseodymium oxide

|

MT

|

300

|

|

NdFeB magnet block

|

MT

|

450

|

|

Rayon

|

MT

|

200

|

|

Samarium-cobalt alloy

|

MT

|

60

|

|

Tantalum

|

LBS Ta

|

64,500

|

|

Tire cord steel

|

MT

|

2,370

|

|

Titanium

|

MT

|

15,000

|

|

Tungsten

|

LBS W

|

4,500,500

|

|

Zirconium

|

MT

|

2,300

|

Source: Annual Materials Plan for FY 2025, DLA-SM-25-3256, (Fort Belvoir, VA: Defense Logistics Agency, 2024): 1; and Glossary of Mining Terminology (Iqualuit, Canada: Indian and Northern Affairs Canada, 2010).

Table 3. Defense Logistics Agency’s annual materials disposal plan for FY 2025

|

Material

|

Unit

|

Ceiling quantity

|

|

Beryllium metal

|

ST (short tons)

|

8

|

|

Carbon fibers

|

LBS

|

92,000

|

|

Chromium, ferro

|

ST

|

24,000

|

|

Chromium, metal

|

ST

|

500

|

|

Germanium

|

KG (kilograms)

|

5,000

|

|

Manganese, ferro

|

ST

|

20,000

|

|

Manganese, metallurgical grade

|

SDT

|

322,300

|

|

Aerospace alloys

|

LBS

|

1,500,000

|

|

Platinum

|

Tr Oz (troy ounces)

|

8,380

|

|

Iridium

|

Tr OX

|

489

|

|

Quartz crystals

|

LB

|

15,712

|

|

Tantalum

|

LBS

|

190

|

|

Tin

|

MT

|

640

|

|

Titanium-based alloys

|

LBS

|

300,000

|

|

Tungsten ores and concentrates

|

LBS W

|

1,100,000

|

|

Zinc

|

ST (stockpile)

|

2,500

|

Source: Annual Materials Plan for FY 2025, DLA-SM-25-3256, (Fort Belvoir, VA: Defense Logistics Agency, 2024): 1; and Glossary of Mining Terminology (Iqualuit, NU: Indian and Northern Affairs Canada, 2010).

Energy Department-Critical Minerals

The 2020 Critical Minerals Act (P.L. 116-260) defines critical material as: Any nonfuel mineral, element, substance, or material that the secretary of energy determines: (i) has a high risk of supply chain disruption; and (ii) serves an essential function in one or more energy technologies, including technologies that produce, transmit, store, and conserve energy. This statute defines critical mineral as: Any mineral, element, substance, or material designated as critical by the secretary of the interior, acting through the director of the U.S. Geological Survey.21

Department of Energy’s (DOE) Undersecretary of Energy for Science and Innovation includes the following “electric eighteen” as critical materials for energy: aluminum, cobalt, copper, dysprosium, electrical steel, fluorine, gallium, iridium, lithium, magnesium, natural graphite, neodymium, nickel, platinum, praseodymium, silicon, silicon carbide, and terbium.22

DOE’s 2023 Critical Minerals Assessment includes the following supply risks for critical materials in the short-term from 2020 to 2025 and medium-term from 2025 to 2035 (figure 3).

Figure 3. Short- and medium-term criticality matrices

Source: Critical Materials Assessment (Washington, DC: Department of Energy, 2023), 106, 110.

This assessment concluded by noting that the dynamism of material criticality requires DOE to regularly revisit this assessment due to the energy transition’s rapid pace. It also stressed that future assessments may consider future areas of improvement including considering materials used in the manufacturing process not making up a product’s final composition or better data and information on recycling. Developing a sharper understanding of recycling markets is key to future materials stock assessments embedded in energy technologies becoming prevalent sources including materials with geopolitical sensitivities. Improvements in understanding and reflecting possible material and system substitutions is critical along with enhancements allowing for assessing multiple supply chain stages.

Key summative findings from the Critical Minerals Assessment include:

• Rare earth materials (neodymium [Nd], praseodymium [Pr], dysprosium [Dy], and terbium [Tb]) used in magnets in electric vehicle (EV) motors and wind turbine generators continue to be critical. While Dy and Tb are both heavy rare earth elements that serve the same function in magnets, the criticality of Tb is slightly lower than that for Dy in the short term due to the widespread use of Dy in high-grade magnets and Tb’s present role as a substitute. Similarly, Pr is critical in the medium term but only near critical in the short term because it is more substitutable in magnets than Nd.

• Materials used in batteries for EVs and stationary storage are now considered critical. While cobalt (Co) was found to be critical in this and previous reports, lithium (Li) becomes critical in the medium term due to its broader use in various battery chemistries and the rampant growth of the EV industry. Natural graphite is a new addition in this assessment and is also found to be critical.

• Platinum group metals used in hydrogen electrolyzers, such as platinum (Pr) and iridium (Ir), are critical due to an increased focus on hydrogen technologies to achieve net-zero carbon emissions, whereas those used in catalytic converters, such as rhodium (Rh) and palladium (Pd), were screened out due to the decreased importance of catalytic converters in the medium term.

• Gallium (Ga) continues to be critical due to its use in light-emitting diodes (LEDs). In addition, the use of Ga has increased in magnet manufacturing and in semiconductors in forms such as gallium arsenide (GaAs) or gallium nitride (GaN).

• Major materials like aluminum (Al), copper (Cu), nickel (Ni), and silicon (Si) move from noncritical in the short term to near critical in the medium term due to their importance in electrification.

• Electrical steel is near critical due to its use in transformers for the grid and electric motors in EVs.23

Department of the Interior: U.S. Geological Survey Minerals Management

On 24 February 2022, the USGS published a list of critical minerals in the Federal Register (table 4). The Administrative Procedure Act, 5 U.S.C., § 551–559, allows interested individuals and organizations to comment on proposed federal agency rules.24 USGS noted that it received 1,073 comments on the critical minerals list during the extended public comment period on this subject. Two comments were made anonymously, 996 came from individuals, 77 were submitted by organizations, and four letters were received after the end of the comment period.

Table 4. List of critical minerals, 2022

|

Aluminum

|

Antimony

|

Arsenic

|

Barite

|

|

Beryllium

|

Bismuth

|

Cerium

|

Cesium

|

|

Chromium

|

Cobalt

|

Dysprosium

|

Erbium

|

|

Europium

|

Flourspar

|

Gadolinium

|

Gallium

|

|

Germanium

|

Graphite

|

Hafnium

|

Holmium

|

|

Indium

|

Iridium

|

Lanthanum

|

Lithium

|

|

Lutetium

|

Magnesium

|

Manganese

|

Neodymium

|

|

Nickel

|

Niobium

|

Palladium

|

Platinum

|

|

Praseodymium

|

Rhodium

|

Rubidium

|

Ruthenium

|

|

Samarium

|

Scandium

|

Tantalum

|

Tellurium

|

|

Terbium

|

Thulium

|

Tin

|

Titanium

|

|

Tungsten

|

Vanadium

|

Ytterbium

|

Ytrium

|

|

Zinc

|

Zirconium

|

|

|

Source: “2022 Final List of Critical Minerals,” Federal Register 87, no. 37 (February 2022): 10381.

Comments included 91 requests to include materials such as copper, phosphate, silver, and lead, which were not on the 2018 critical minerals list, and helium, potash, and uranium, which were on the 2018 final list but not on the 2022 draft list. None of the comments identified inaccuracies in data used to conduct quantitative evaluation with published USGS methodology.25

USGS’s National Minerals Information Center serves as a one-stop gateway for statistics and information on global supplies, demand, and mineral and materials flow emphasizing U.S. economic essentials, national security, and environmental protection.26 Their 2024 Critical Minerals Summary report notes that the United States consumed approximately four percent of world chromite ore production in varying forms of imported material including chromite ore, chromium chemicals, ferrochromium, chromium metal, and stainless steel. U.S. chromium material consumption (measured by net imports) fell from $1.5 billion in 2022 to $830 million, representing a 44 percent decline. Import sources for U.S. chromium consumption between 2019–2022 are available in table 5.

Tariffs issued by the president and Congress and documented by the U.S. International Trade Commission for importing various varieties of chromium from countries the United States has normal trade relationships with as of 31 December 2023 are available in table 6.

Table 5. USGS chromium minerals commodity summary

|

Chromite (ores and concentrates)

|

South Africa

97%

|

Turkey

2%

|

Other

1%

|

|

|

Chromium (containing scrap)

|

Canada

52%

|

Mexico

43%

|

United Kingdom 1%

|

Other

4%

|

|

Chromium (primarily metal)

|

South Africa

28%

|

Kazakhstan

15%

|

Russia

8%

|

Finland

5%; other 44%

|

|

Chromium-containing chemicals

|

Kazakhstan 22%

|

Germany 20%

|

China 19%

|

Italy 14%; other 25%

|

|

Total imports

|

South Africa

34%

|

Kazakhstan

12%

|

Russia

6%

|

Canada 5%; others 43%

|

Source: Linda R. Rowan, Critical Mineral Resources: The U.S. Geological Survey (USGS) Role in Research and Analysis (Washington, DC: Congressional Research Service, 2024); and Mineral Commodities Summary 2024 (Reston, VA: USGS, 2024): 58.

Table 6. Tarriffs issues on varieties of chromium

|

Chromium ores and concentrates

|

Free

|

|

Ferrochromium

|

1.9% ad valorem (at value) to 3.1% ad valorem depending on percentage of carbon.

|

|

Ferrosilicon Chromium

|

10% ad valorem

|

|

Chromium Metal

|

Free-3%

|

Source: Mineral Commodities Summary 2024 (Reston, VA: USGS, 2024), 58; and Harmonized Tariff Schedule of the United States, rev. 9, (Washington, DC: International Trade Commission, 2024).

This document’s section on titanium mineral concentrates notes the domestic and international production of ilmenite, an iron-black metal containing an oxide of iron and titanium and rutile (a reddish-brown to black mineral that consists of titanium dioxide usually with a little iron and has a brilliant metallic or adamantine luster) with countries such as Australia, Canada, and China ranking higher than the U.S. in production and reserves (table 7).

Table 7. Titanium mineral concentrates

|

|

Mine production

|

Reserves8

|

|

|

2021

|

2022e

|

|

|

Ilmenite:

United States2, 9

Australia

Brazil

Canada11

China

India

Kenya

Madagascar11

Mozambique

Norway

Senegal

South Africa11

Ukraine

Vietnam

Other countries

World total

(ilmenite, rounded)9

|

100

600

33

430

3,400

204

181

414

1,100

468

482

900

316

122

137

8,900

|

200

660

32

470

3,400

200

180

300

1,200

430

520

900

200

160

77

8,900

|

2,000

160,00010

43,000

31,000

190,000

85,000

390

22,000

26,000

37,000

NA

30,000

5,900

1,600

14,000

650,000

|

|

Rutile:

United States

Australia

India

Kenya

Madagascar

Mozambique

Senegal

Sierra Leone

South Africa

Tanzania

Ukraine

Other countries

World total (rutile,

rounded)9

World total

(ilmenite and rutile,

rounded)

|

(9)

190

12

72

—

8

9

123

95

—

95

14

618

9,500

|

(9)

190

11

73

—

8

9

130

95

—

57

14

590

9,500

|

(9)

31,00010

7,400

170

520

890

NA

490

6,500

20

2,500

NA

49,000

700,000

|

8 World resources: Ilmenite accounts for about 90 percent of the world’s consumption of titanium minerals. World resources of anatase, ilmenite, and rutile total more than 2 billion tons.

Substitutes: Ilmenite, leucoxene, rutile, slag, and synthetic rutile compete as feedstock sources for producing TiO2 pigment, titanium metal, and welding-rod coatings.

e Estimated; NA=not available; — = zero.

1 See also the titanium and titanium dioxide chapter.

2 Rounded to the nearest 100,000 tons to avoid disclosing company proprietary data.

3 Defined as production + imports – exports.

4 Fast Markets IM; average of yearend price.

5 Zen Innovations AG, Global Trade Tracker.

6 Landed duty-paid unit value based on U.S. imports for consumption. Source: U.S. Census Bureau.

7 Defined as imports–exports.

8 See appendix C for resource and reserve definitions and information concerning data sources.

9 U.S. rutile production and reserves data are included with ilmenite.

10 For Australia, Joint Ore Reserves Committee-compliant or equivalent reserves for ilmenite and rutile were estimated to be 37 million and 9.2 million tons, respectively.

11 Mine production of titaniferous magnetite is primarily used to produce titaniferous slag.

Source: Mineral Commodity Summaries (Washington, DC: USGS, 2023), 187.

Congressional Activity

Congress and its multiple oversight entities seek to shape U.S. government policy in multiple areas such as legislation, funding, and oversight of the performance of U.S. critical and strategic materials including mandating federal agency compilation of reports and data.27

During the 118th Congress from 3 January to 13 November 2024, 101 proposed bills or resolutions on “critical minerals” were introduced in both the House of Representatives and Senate, referred to various committees, and various degrees of action were taken or not taken on them.28 As of 14 November 2024, 53 were introduced in the House with the rest being introduced in the Senate, with 58 bills being introduced in 2023 and 43 in 2024. These examples of proposed legislation were referred to 24 committees in both chambers with the House Committee on Natural Resources and the Senate Energy and Natural Resources Committee receiving 20 and 12 bills, respectively, on this subject. One hundred members of Congress introduced legislation or resolutions on this subject during this congressional session with the bicameral division for this session to the aforementioned date being 43 senators and 57 representatives.29

Examples of bills from each chamber include Securing American Critical Minerals Act of 2023, H.R. 118–22 and the Intergovernmental Critical Minerals Task Force Act, S. 1871, H. R. 5021, was introduced by Representative Betty McCollum (D-MN) on 27 July 2023 and referred to the House Committee on Natural Resources. It aspired to prohibit selling or transferring certain critical materials to foreign entities of concern by individuals conducting certain mineral activities on federal land. It directed the secretary of the interior to cooperate with the secretary of commerce and other federal agencies to determine penalties for violations of this proposed statute and to make a public report by 30 June of each year identifying individuals selling or transferring covered minerals, which are critical minerals defined in the Energy Act, sections 7002 of the 2020, and legally codified as Mineral Security, 30 U.S.C., S. 1606. This legislation has received no subsequent consideration.30

The Intergovernmental Critical Minerals Task Force Act was introduced by Senators Gary Peters (D-MI), James Lankford (R-OK), and Mitt Romney (R-UT) and referred to the Senate Homeland Security and Governmental Affairs Committee. It sought to create intergovernmental coordination between state, local, tribal and territorial jurisdictions, and enabled the federal government to combat U.S. reliance on China and covered countries for critical minerals and rare earth minerals. Covered countries are defined as U.S. geostrategic competitors or adversaries concerning strategic minerals. If enacted, this legislation required the director of each entity to establish a task force within 90 days to facilitate cooperation, coordination, and mutual accountability among these jurisdictions to create a holistic response to this dependence. Such a response would include assessing the amount of critical minerals mined, processed, recycled, and refined by China, other covered countries, and the United States, determine alternative minerals in the United States that can be used to substitute for these materials emanating from covered countries; mitigate supply chain risks for critical materials from China and other covered countries; provide research and development recommendations into emerging technologies for expanding existing U.S. critical mineral supply chains in the United States; strengthen the domestic work force to support increasing growing U.S. critical mineral supply chains, and improve partnerships between the U.S. and allied countries in these arenas. The bill mandated that the task force director publish a report describing findings, guidelines, and recommendations within two years of the enactment of this legislation.31

On 5 September 2023, the Senate Homeland Security and Governmental Affairs Committee issued a report approving this legislation. This legislation passed the Senate on 18 September 2024 and was referred to the House on 19 September 2024 with no subsequent action occurring in that chamber.32

Congressional Committees

Congressional committees are responsible for approving new legislation, revising existing legislation, funding government programs, and conducting oversight of government program performance.33 Recent congressional sessions have seen significant exploration of critical minerals policymaking scrutiny in both the House and Senate. A 31 March 2022 Senate Energy and Natural Resources Committee hearing addressed opportunities and challenges confronting U.S. critical mineral mining, processing, refining, and reprocessing. Committee chair Senator Joe Manchin (D-WV) opened with the following observation about U.S. reliance on foreign suppliers for critical minerals.

In the immediate term, our concern is . . . Russia . . . I am also extremely concerned with China as the gatekeeper of the critical minerals that we need for everyday life that we really have taken for granted. In addition to the minerals crucial to energy and defense applications, it makes no sense to remain beholden to actors when we have abundant resources and manufacturing knowledge here in the United States. . . . We are beholden, particularly when it comes to many of the minerals that go into clean energy technologies. That is why I sounded the alarm about going down the path of EV’s alone and advocated for equal treatment for hydrogen. China mines 60% of global rare earth elements crucial to high-tech applications and magnets needed for electric motors. Even more shocking, China processes almost 90% of the rare earths, regardless of where they are mined in the world. The only large scale producers of cobalt are in the Democratic Republic of the Congo, where Chinese interests control many of the mines . . . 65% of the processing is done in China. Lithium is mined extensively by Australia, an ally that produces over 50% of global supply. However, China processes over 58% of global lithium, and uses that material to feed their lithium battery manufacturing.34

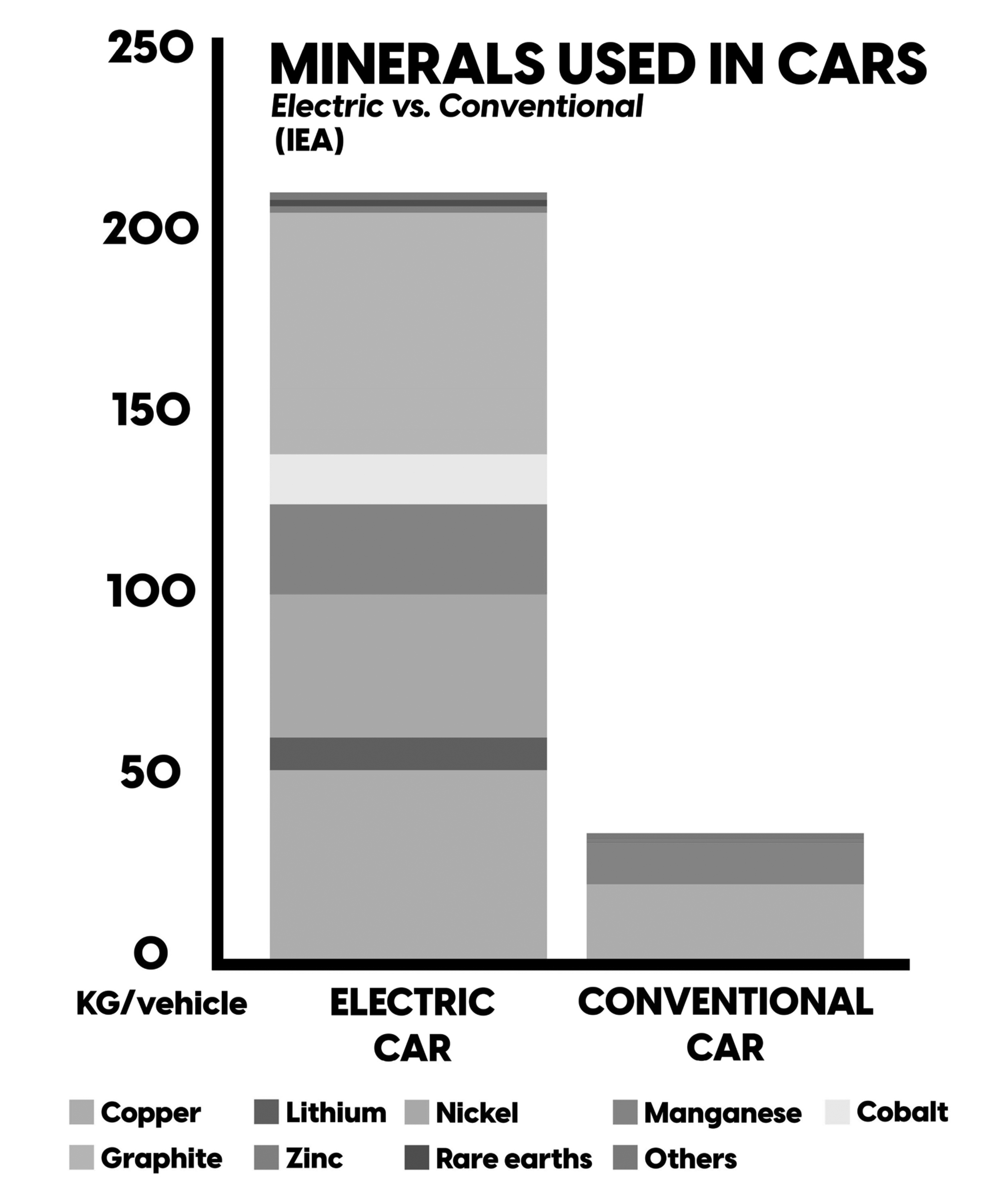

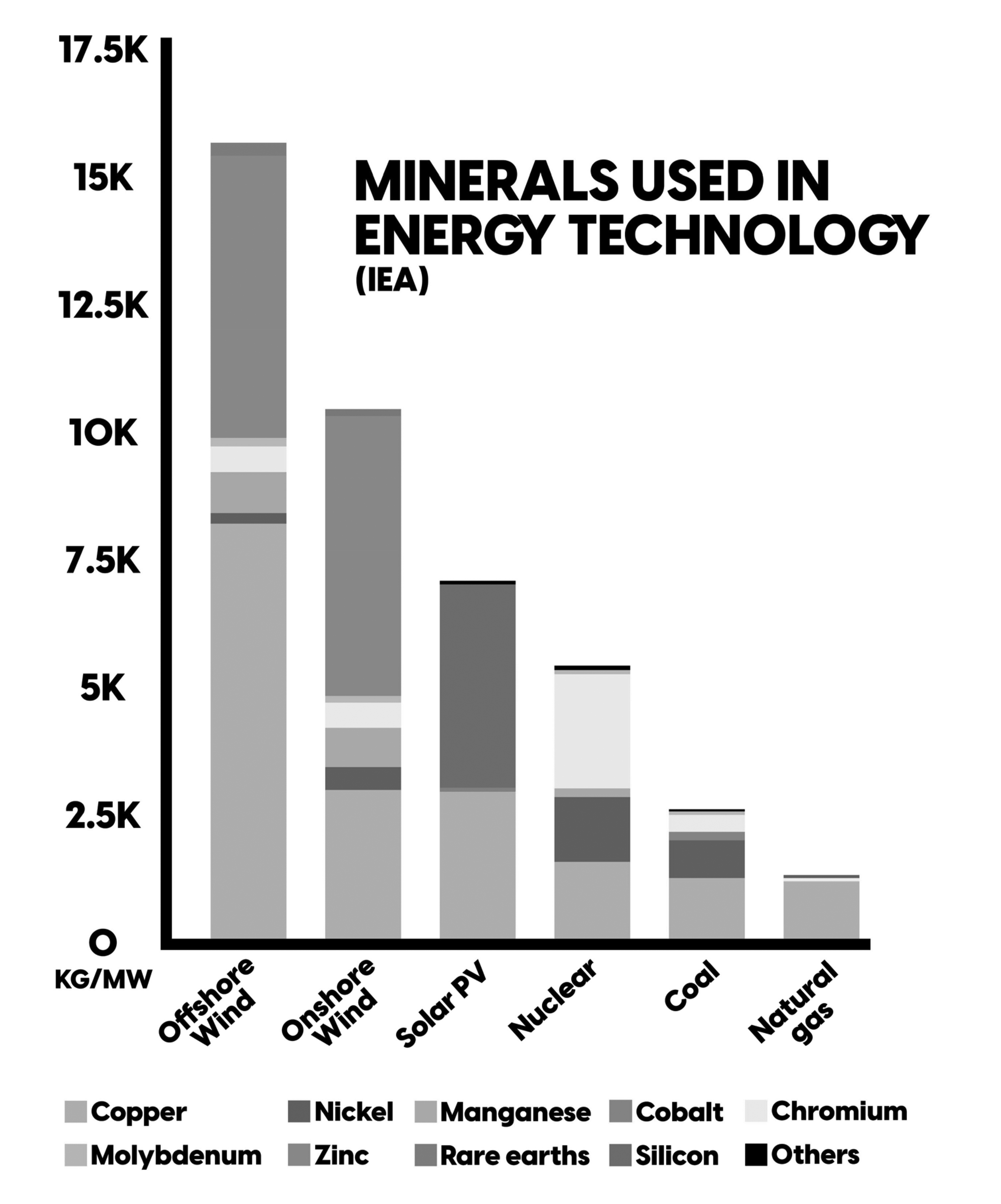

Committee ranking member Senator John Barasso (R-WY) expressed concern about Biden administration desires to achieve zero emission vehicles within eight years by including two charts from the International Energy Agency (IEA) into the hearing transcript comparing the minerals used in electric and conventional cars and in energy technology. These charts document that electric vehicles require much more minerals than internal combustion engines and wind turbines and solar panels require more minerals than coal-fired, natural gas, and nuclear plants (figures 4 and 5).

Figure 4. Minerals used in cars

Source: U.S. Congress, Senate Committee on Energy and Natural Resources, Opportunities and Challenges Facing Domestic Critical Mineral Mining, Processing, Refining, and Reprocessing (Washington, DC: GPO, 2024), 5.

Figure 5. Minerals used in energy technology

Source: U.S. Congress, Senate Committee on Energy and Natural Resources, Opportunities and Challenges Facing Domestic Critical Mineral Mining, Processing, Refining, and Reprocessing (Washington, DC: GPO, 2024), 5.

A 13 September 2023 House Natural Resources Committee hearing examined the methodological structure of USGS’s critical minerals list. Representative Pete Stauber (R-MN) noted that demand for hard rock minerals including cobalt, lithium, nickel, silver, and zinc is expected to increase rapidly in the near future and that his congressional district in northeastern Minnesota has significant quantities of these minerals, which are critical for most high-tech devices including cell phones, defense systems, and satellites. He expressed concern that, while the Biden administration rhetorically advocated for increased renewable energy and electric vehicle mandates, it chose to eliminate access to lands with high mineral potential including 225,504 acres withdrawn from development in January 2023 encompassing the world’s largest copper nickel resource at Minnesota’s Duluth complex along with creating a new national monument adjacent to Arizona’s Grand Canyon blocking access to the United States’ richest uranium deposits.35

Nedal T. Nassar, USGS’s chief of minerals intelligence research, noted that the Energy Act of 2020 requires USGS to coordinate with other federal agencies in developing a whole-of-government list of critical minerals and identify commodities with elevated supply risk. He noted that the 2022 critical minerals list identified gallium as representing the United States’ greatest supply risk due to recent Chinese export controls imposed on gallium and germanium products. Gallium is important to semiconductors used in telecommunications such as 5G networks, consumer electronics, solar photovoltaics, electric vehicles, and defense applications with China producing 98 percent of this commodity’s global supply.36

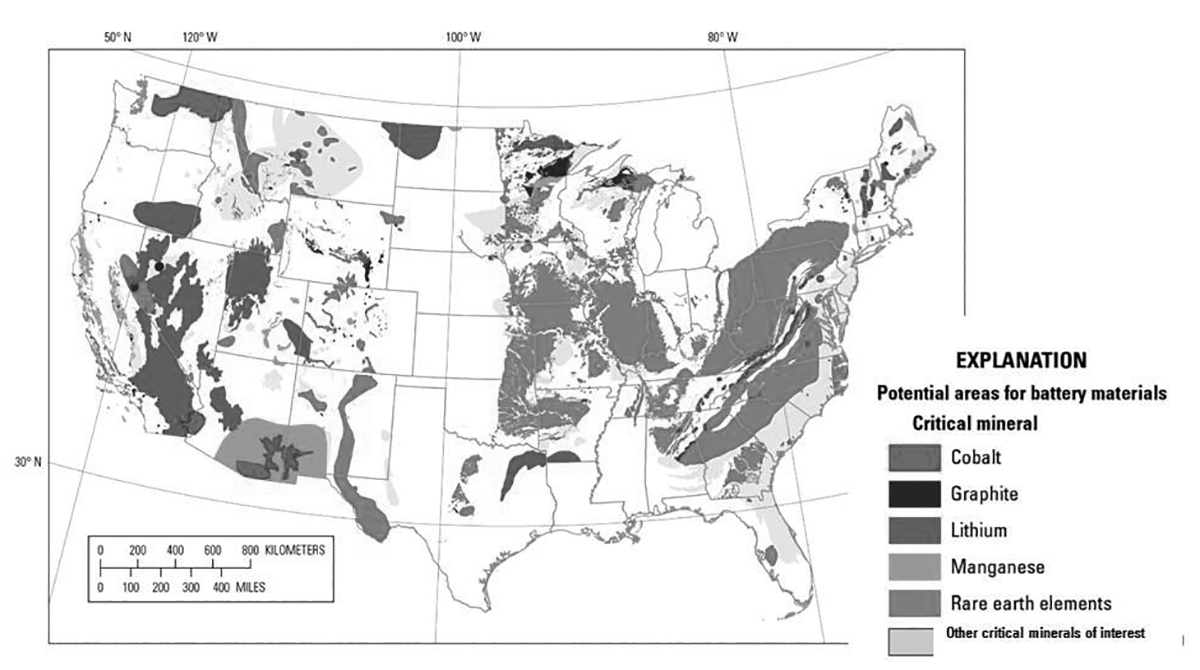

The following map notes areas with potential conterminous U.S. subsurface mineral resources required for high-capacity batteries including cobalt, graphite, lithium, manganese, and rare earth elements (figure 6).

Figure 6. Areas with potential for battery materials

Source: C. L. Dicken and J. M. Hammarstrom, “GIS for Focus Areas of Potential Domestic Resources of 11 Critical Minerals,” data release, U.S. Geological Survey, 2020, https://doi.org/10.5066/P95C08LR.

Reed Blakemore of the Atlantic Council’s Global Energy Center notes that critical materials or minerals can vary from industry to industry with significant metal commodities being important to national economic health and small quantities of niche supply-constrained materials being equally important to pharmaceutical and semiconductor industries. Where defense is concerned, Blakemore notes critical materials include antimony, ferromanganese, gallium, lithium, and nickel. Every Virginia-class (SSN 774) submarine requires 9,200 pounds of rare earth elements (REE), while Lockheed Martin F-35 Lightning II aircraft require 920 pounds of REE. Cobalt is an important part of critical magnets used in energy technologies and military technologies including aircraft, guided missiles, and smart bombs.37

A 30 November 2023 House Oversight Committee hearing focused on providing safety and security in the critical mineral supply chain. The subcommittee chair Representative Pat Fallon (R-TX) commented that the United States produces only 14 of the 50 critical materials USGS, DOD, and DOE consider critical for domestic economic and security requirements. He added that China dominates global supply chains, controlling 60 percent of production, 90 percent of processing, and 75 percent of critical minerals manufacturing. Fallon also noted that China uses aggressive international investment practices to access what it cannot produce domestically as demonstrated by Chinese companies owning or financing 15 of 19 cobalt mines in the Democratic Republic of Congo, which use child labor.38

Steve Feldgus, the deputy assistant secretary for land and minerals management in the Interior Department, noted that the 1872 Mining Law has shaped domestic mineral production on federal lands by allowing for developing nearly all mineral resources. In 1920, Congress enacted the Mineral Leasing Act removing petroleum, natural gas, and other hydrocarbons from the Mining Law and creating a lease-based system for such minerals. The 1947 Materials Act removed common materials including sand and gravel from the Mining Law, making them subject to sale of permit. Currently, nearly all hard rock minerals on federal land, including precious minerals such as gold and silver, fall under the Mining Law, which also applies to critical minerals including cobalt, graphite, and lithium needed to support the contemporary economy and promote a transition to renewable energy.39

Isabella Munilla, the deputy assistant secretary for multilateral engagement, climate and market development in DOE’s Office of International Affairs, contended that U.S. demand for critical minerals and materials would increase four to six times during the next three decades with no single country being able to satisfy global demand. She also warned that U.S. reliance on nonallied foreign sources for these materials is unsustainable and insecure.40

Halimah Najieb-Locke, DOD’s deputy assistant secretary of defense for industrial base resilience maintained:

We know from history that industrialized nations that do not have secure and reliable access to critical materials during conflicts have suffered performance tradeoffs that contributed to their defeat on the battlefield. . . . The Department seeks stable access to arrange these materials for everything from large capacity batteries and microelectronics to conventional munitions and missiles, and new chemistries for next generation weapons and aircraft. We rely on these materials ask key components to power computation for DoD weapons systems.41

She went on to stress the importance of the National Defense Stockpile (NDS) as the United States’ stockpile for strategic and critical materials with NDS serving as a buffer during emergencies. These reserves allow the United States to release materials to keep critical production lines operating until long-term supply chains are restored. Her remarks concluded by reiterating the importance of relying on international partners to bolster domestic capacity, citing the need to strengthen military partnerships such as the Australia, United Kingdom, United States (AUKUS) nuclear submarine agreement as key factors in enhancing critical material readiness.42

Representative Byron Donalds (R-FL) noted existing regulatory burdens from agencies such as the Environmental Protection Agency (EPA) and Bureau of Land Management (BLM) prohibit permitting flexibility in extracting domestic critical mineral resources. Feldgus and Munilla responded by noting that streamlining permitting processes is essential to achieving domestic critical minerals production capacity.43

Government Accountability Office (GAO)

A July 2024 report by this congressional support agency conducted a technology assessment of critical minerals including the potential for recovering them from nontraditional sources. Such sources include mining waste, water from existing mines, waste from coal-fired plants, and saline groundwater (brine) from geothermal power plants. Recovering minerals from coal and mining waste requires operators to repurpose mature technologies already used in the mining industry. Most of these projects are at pilot scale with direct extraction from geothermal brines closer to commercial-scale operation with one plant expected to become operational in 2025.44

Factors involved in identifying where difficulties may arise in recovering critical minerals from nontraditional sources include:

• Liability: Recovery operations on previously mined sites could result in operators being responsible for historical liabilities. There is little appetite in industry to take on this financial risk, according to experts.

• Economics: Due to factors such as high fixed costs and unstable prices, potential recovery project operators may be uncertain that their investments will be financially viable.

• Public engagement and tribal consultation. Stakeholders and experts identified engagement with local communities, and when appropriate, government-to-government consultation with tribal nations as important steps to a successful critical mineral recovery project.45

GAO recommended policy options potentially capable of addressing or enhancing critical mineral recovery from nontraditional sources of minerals (table 8).

Table 8. Policy options to address challenges or enhance benefits of recovering critical minerals from nontraditional sources

|

Policy option

|

Opportunities

|

Considerations

|

|

Pilot Good Samaritan Legislation

Implementation approaches: Legislators could provide some liability protections from third parties recovering critical minerals at previously mined sites and require that a portion of profits generated be used for restoration activities.

|

• Could encourage investment in domestic recovery operations.

• Could expand types of organizations interested in cleaning up previously mined sites.

|

• Disturbing previously mined sites may result in new environmental effects.

• If financial assumptions are not adequately set, federal or state taxpayers may become liable for cleaning up environmental liabilities.

• Requiring a percentage of profits to be used for restoration activities could affect industry interest in previously manned sites.

|

|

Subsidies

Implementation approaches: The federal government could subsidize developing specific nontraditional sources to meet energy and defense needs via tax credits.

|

• Properly tailored subsidies could boost technology development, demonstration, commercialization, and domestic critical mineral production.

• Subsidies could offset some fixed costs with developing recovery and processing infrastructure.

|

• Taxpayer-funded subsidies do not guarantee supported recovery operations become profitable.

• Subsidies can be difficult to end.

• May result in resource reallocation from other priorities.

|

|

Community benefit agreements

Implementation approaches:

Improve engagement with communities near nontraditional sources, permitting agencies could encourage operators to pursue agreements outlining how communities may benefit from projects incurring costs in their communities.

Companies could adopt policies encouraging or facilitating these agreements.

|

• Negotiating specific community benefits from new recovery projects could create deeper acceptance of facilities possibly having environmental effects.

• New recovery operations could offer additional employment opportunities in economically distressed communities.

|

• Negotiating which stakeholders benefit, which do not, and who controls the agreement can be challenging.

• Predicting who will engage in such agreements is difficult.

• Creating these agreements may be time-consuming.

• Some provisions in agreements may be difficult to enforce.

|

|

Status Quo

Implementation approach: Sustain current efforts.

|

• Federal policymakers could observe and evaluate existing efforts, such as agency funding of nontraditional sources, possibly limiting risk and resources expended.

• Continued private sector efforts, like recovering lithium from geothermal brines, could eventually produce profitable mineral recovery.

• Private sector may pursue other options for overcoming critical mineral supply chain problems including buyers pursuing substitutes, reducing the need for new resources.

|

• Current efforts may not address challenges described in this report.

• Current efforts could delay or inhibit developing nontraditional sources for critical minerals potentially resulting in in forgone benefits including increased independence from foreign suppliers.

|

Source: Critical Minerals: Status, Challenges, and Policy Options for Recovery from Nontraditional Sources (Washington, DC: GAO, 2024).

Conclusion

Strategic minerals will remain important features of consumer convenience and communication, business enterprise, and military activity. Factors influencing national mineral power include domestic production, government stockpiles, overseas production, mineral import and resources, national influences on mineral demand, international exchanges, market transparency, mineral companies, and other factors.46

This will require a highly educated and paid workforce to help the United States enhance its ability to produce and refine these resources. The Bureau of Labor Statistics Occupational Outlook Handbook maintains that the job outlook for materials engineers will increase 7 percent between 2023 and 2033 and that their 2023 median pay is $104,000. This same source claims that mining and geological engineers job outlooks will grow 2 percent between 2023 and 2033 with their 2023 median pay being $100,640, while geoscientists job outlooks will grow 5 percent between 2023 and 2033 with their 2023 median pay being $92,580.47

The second Trump administration may incorporate its 2019 Commerce Department report findings on expanded access to critical material including: identifying options for accessing and developing critical minerals through investment and trade with America’s allies, discussing areas for international collaboration and cooperation, and ensuring robust enforcement of U.S. trade laws and international agreements that address adverse impacts of market-distorting foreign direct trade conduct.48

The United States must expand financial support for domestic exploration, mining, and processing with DOD already providing financial support for cobalt and nickel exploration; antimony, graphite, and lithium mining; and aluminum, graphite, and titanium refining. Imposing tariffs on foreign minerals could assist domestic producers, and the United States should drastically bolster its stockpiles of critical minerals and enhance the number of geographic locations. It should also do business solely with overseas mineral production entities in countries geopolitically aligned with the United States and, given U.S. dependence on China for minerals such as gallium and magnesium, it should diplomatically notify Beijing that export controls it places on these exports to the United States will result in retaliatory U.S. export controls on technology to China.49

There are ongoing congressional efforts to enhance U.S. critical minerals policymaking. The Critical Mineral Consistency Act was passed by the House on 14 November 2024. This legislation modifies the 2020 Energy Act to expand the definition of critical materials to include materials designated critical by DOE. It would require USGS to post materials on DOE’s list, including copper, electrical steel, silicon, and silicon carbide on the critical minerals list; standardize criteria for identifying critical minerals and include provisions to reduce reliance on foreign imports by encouraging domestic mining, refining, and recycling efforts; and ensure critical mineral projects, including copper mine projects are eligible for expedited FAST-41 permitting improving federal interagency coordinating by establishing a two-year environmental review goal permitting covered federal infrastructure projects to proceed.50

Critical minerals are a subject of such importance that the president and other cabinet departments should make active and ongoing efforts to reach out and cultivate contacts with traditional broadcast and social media sources. The president and senior officials in these departments should provide succinct and informative information on this subject with widely viewed programs such as television network evening newscasts and social media podcast influencers to publicize and spread awareness of this subject. President Trump should also emulate the example of former Canadian prime minister Justin Trudeau and prepare mandate letters to cabinet ministers with critical minerals responsibilities such as the Departments of Commerce, Energy, Defense, and Interior. Such letters should give these ministers explicit directions on achieving critical mineral objectives within specified time periods as occurred in Trudeau’s letter to Minister of Natural Resources Jonathan Wilkinson directing him to launch a Canadian critical minerals strategy, improve supply chain resilience, and position Canada as the leading mining nation.51

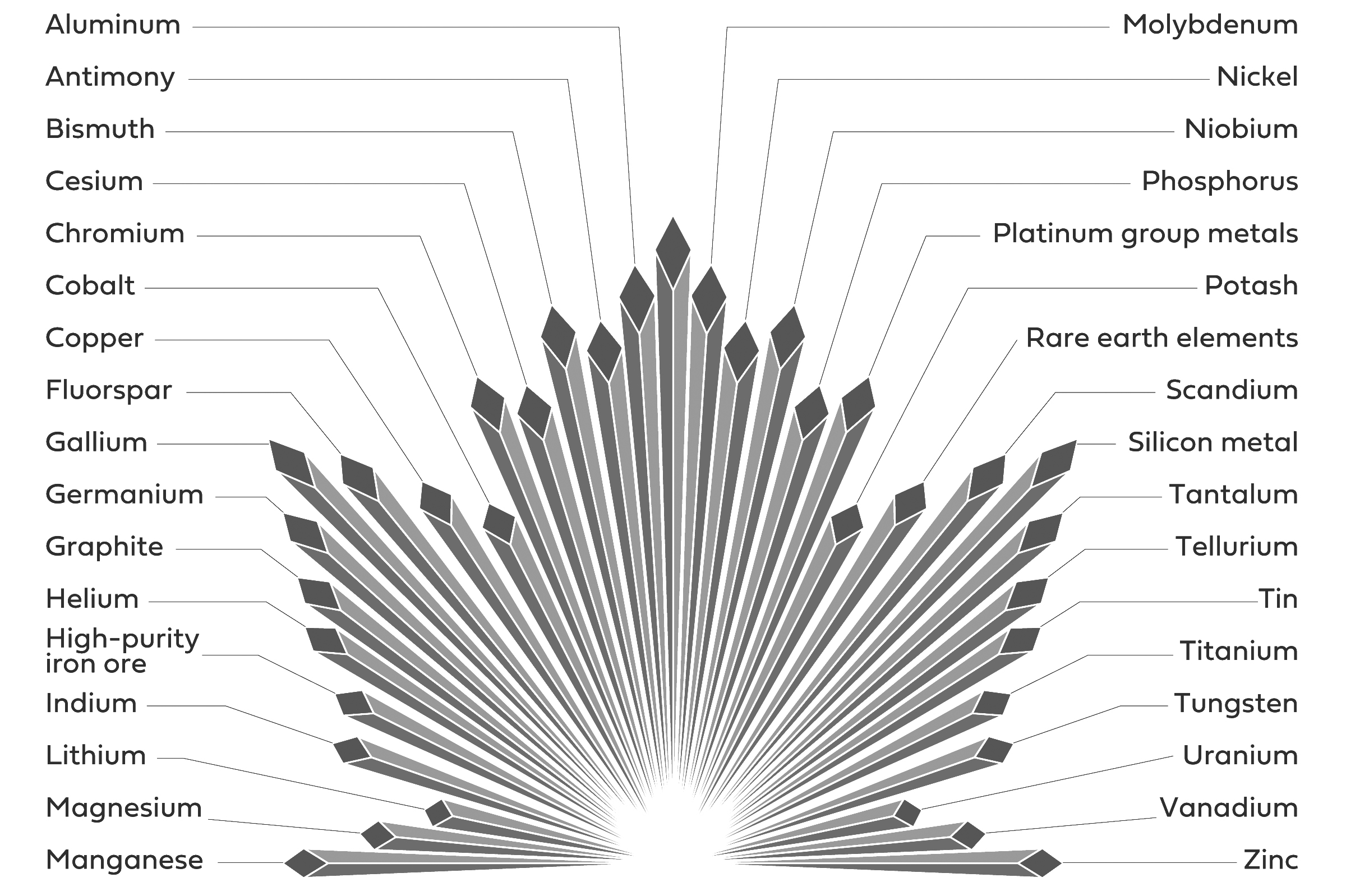

Canada, Greenland, and Ukraine are likely to play some role in future delivery of critical minerals to the United States. The 34 metals and minerals in figure 7 were listed on Ottawa’s critical minerals list on 10 June 2024.

Figure 7. Canadian natural resources

Source: “Canada’s Critical Minerals,” Government of Canada, accessed 23 April 2025.

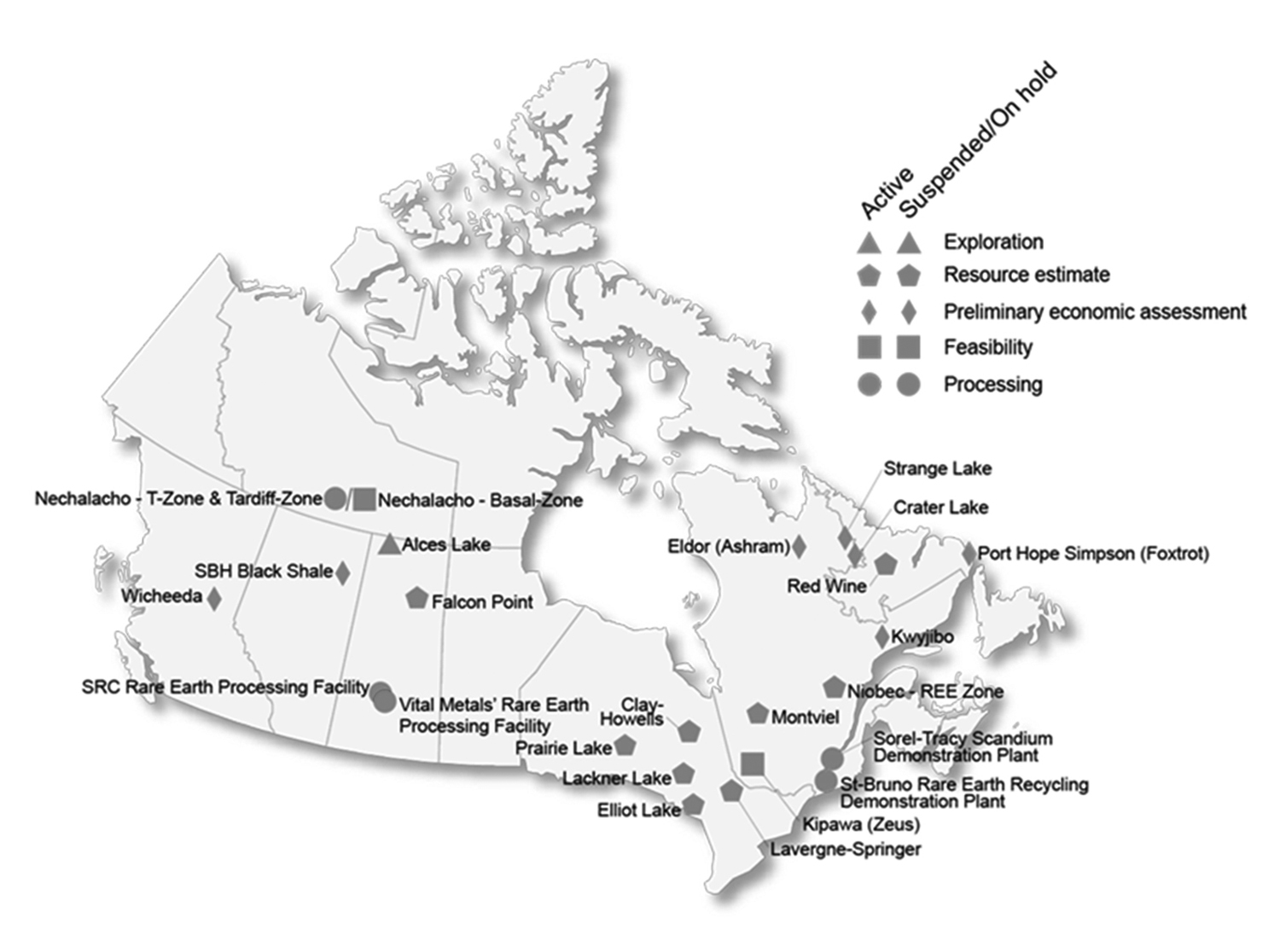

While Canada does not currently produce rare earth elements, it is believed to have 15.2 million tons of rare earth oxide reserves scattered across Canada with particularly strong reserves in Ontario and Quebec and may choose to begin such production (figure 8).

Figure 8. Canadian rare earth deposits

Source: “The Outlook for Development of Canada’s Rare Earth,” Innovation News Network, 5 April 2024.

The Trump administration has an acute interest in acquiring Greenland for geopolitical reasons, including its potential strategic mineral resources. These include copper, gold, graphite, ilemite, iron ore, lead, molybdenum, nickel, precious stones, rare-earth elements, silver, titanium, uranium, and zinc. Greenland’s Ministry of Natural Resources has a strategic plan for 2020–24, which includes the sustainable development of these resources and developing a competitive tax and royalty model. Its proximity to potential trade routes has also attracted interest from China and Russia and key locations of Greenland’s critical minerals include southern Gardar Province and other locales.52

Ukrainian strategic minerals are also of interest to the Trump administration as demonstrated by efforts to negotiate delivery of these commodities to the United States as conditions for further U.S. assistance to Ukraine in its three-year war against Russia. USGS reports the total value of Ukrainian mineral deposits located in Russian-occupied areas as $12.4 trillion with 33 percent of these deposits being rare earths and other critical minerals including lithium. During 2022, Ukrainian mineral trade decreased 64.8 percent, falling to $44.1 billion. Nevertheless, USGS assesses that Kyiv is likely to remain a leading global producer of manganese, titanium ore, and titanium sponge though its ability to remain metallurgically competitive could prove difficult due to high energy costs, requiring new investments in this sector, differing priorities of plant owners and the government, and the ongoing military situation.53

On 2 April 2025, Trump announced an executive order instituting a broad range of tariffs against many countries on multiple products. Expressing concern about what his administration saw as a lack of reciprocity in bilateral trade relationships, disparate tariff rates and nontariff barriers, concerns over acute U.S. defense supply dependence on adversarial countries, depleted U.S. defense stocks, and continuing annual U.S. trade deficits were listed as reasons for issuing these tariffs. Concern about critical mineral access was also included when announcing these tariffs. The long-term impact of these tariffs and potential retaliatory action against them by other countries and how this might affect critical materials access, pricing, and supplies remains uncertain.

Critical minerals will continue influencing the civilian and military economic activity and national security strategies of the United States and other nations for years to come. The United States and other international countries, particularly those allied with the United States, will need to work diligently to coordinate their strategies in this policymaking arena, avoid supply chain dependence on hostile providers, ensure that domestic production and processing occurs with minimal adverse environmental impact, includes consultation and profit sharing with all stakeholders in affected areas, and continually and transparently publicizing national dependence on these resources to taxpayers and concerned citizens.

Endnotes

1. See Gregory Wischer and Morgan Bazilian, “The Rise of Great Mineral Powers,” Journal of Indo-Pacific Affairs 7, no. 2 (March–April 2024): 162; and David Humphreys, “Mining and Might: Reflections on the History of Metals and Power,” Mineral Economics 37 (2023): 194, https://doi.org/10.1007/s13563-023-00377-z.

2. Linda R. Rowan, Critical Mineral Resources: National Policy and Critical Minerals List (Washington, DC: Congressional Research Service, 2024), 1.

3. Minerals, Critical Materials, and the U.S. Economy (Washington, DC: National Academies Press, 2008), 207–9, 219–21.

4. Managing Materials for a Twenty-First Century Military (Washington, DC: National Academies Press, 2008), 7–22.

5. Executive Order No. 13817, A Federal Strategy To Ensure Secure and Reliable Supplies of Critical Minerals (20 December 2017).

6. Executive Order No. 13953, Addressing the Threat to the Domestic Supply Chain from Reliance on Critical Minerals from Foreign Adversaries and Supporting the Domestic Mining and Processing Industries (30 September 2020).

7. A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals (Washington, DC: Department of Commerce, 2019), 1; and Executive Order No. 13817.

8. See Consolidated Appropriations Act; and “What Are Critical Materials and Critical Minerals?,” Department of Energy, accessed 17 April 2025.

9. See Consolidated Appropriations Act.

10. Exec. Order No. 14017, Securing America’s Supply Chains (24 February 2021).

11. See Exec. Order No. 14017; Defense Production Act, 50 U.S.C. § 4501; Alexandra G. Neenan and Luke A. Nicastro, The Defense Production Act of 1950: History, Authority, and Considerations for Congress (Washington, DC: Congressional Research Service, 2023); Strategic and Critical Materials Stockpiling Act, 50 U.S.C. 98; and Cameron M. Keys, Emergency Access to Strategic and Critical Materials: The National Defense Stockpile (Washington, DC: Congressional Research Service, 2023).

12. Keys, Emergency Access to Strategic and Critical Materials, 135–40; and Technology Assessment Critical Minerals: Status, Challenge, and Policy Options for Recovery from Nontraditional Sources (Washington, DC: Government Accountability Office, 2024), 4.

13. Building Resilient Supply Chains, Revitalizing American Manufacturing, and Fostering Broad-Based Growth: 100-Day Reviews Under Executive Order 14017 (Washington, DC: White House, 2021), 121, 134–48.

14. Presidential Determination No. 2022-11 as of 31 March 2022: Presidential Determination Pursuant to Section 303 of the Defense Production Act of 1950 as Amended.

15. Executive Order No. 14154, Unleashing American Energy (20 January 2025).

16. Executive Order No. 14241, Immediate Measures to Increase American Mineral Production (20 March 2025); and Exec. Order No. 14213, Establishing the National Energy Dominance Council (14 February 2025); and “Innovation Capability and Modernization,” Industrial Base Policy, accessed 2 April 2025.

17. A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals, 4–5.

18. “The Defense Department’s Strategic and Critical Minerals Review,” press release, Department of Defense, 8 June 2021.

19. “About Strategic Minerals,” Defense Logistics Agency, accessed 12 November 2024.

20. “Resources: Depot Information,” Defense Logistics Agency, accessed 12 November 2024.

21. Consolidated Appropriations Act.

22. “What Are Critical Materials and Critical Minerals?”

23. Critical Materials Assessment (Washington, DC: Department of Energy, 2023), xi, 110.

24. Administrative Procedure Act, 5 U.S.C., § 551–559.

25. See 34 U.S.C. § 10381; for public comments submitted, see “2021 Draft List of Critical Materials,” Regulations.gov, accessed November 14, 2024; and Nedal T. Nasser and Stephen M. Fortier, Methodology and Technical Input for the 2021 Review and Revision of the U.S. Critical Minerals List (Reston, VA: U.S. Geological Survey, 2021).

26. “National Minerals Information Center,” U.S. Geological Survey, accessed 14 November 2024. For information on USGS’s role in critical mineral research and analysis, see Linda R. Rowan, Critical Mineral Resources: The U.S. Geological Survey (USGS) Role in Research and Analysis (Washington, DC: Congressional Research Service, 2024).

27. See Jerrold Zwirn, Congressional Publications and Proceedings, 2d ed. (Littleton, CO: Libraries Unlimited, 1988); Omanjana Goswani, “Chipping In: Critical Minerals for Semiconductor Manufacturing in the U.S.,” MIT Science Policy Review 4 (2023): 118–26, https://doi.org/10.38105/spr.tnepby7ntp; and Robert Curl, “Mining Our Own Business: The Critical Mineral Supply Chain and the General Mining Law of 1872,” Arizona State Law Journal 56, no. 2 (summer 2024): 1133–66.

28. Author performed a document search for “critical minerals” on GovInfo.gov for congressional bills between January 2023 and November 2024, yielding 112 records.

29. See Securing American Critical Minerals Act of 2023, H.R. 5021, 118th Cong. (2023).

30. 30 U.S. Code § 1606, Mineral Security (2020).

31. See Intergovernmental Critical Minerals Task Force Act Report of the Committee on Homeland Security and Governmental Affairs, United States Senate, Senate Report 118-93 (Washington, DC: Government Printing Office, 2023); 170 Cong. Rec. S6184-618; and 170 Cong. Rec. S6184-618.

32. Intergovernmental Critical Minerals Task Force Act, S. 1871, 115th Cong. (2023–24).

33. U.S. Congress, Senate Committee on Energy and Natural Resources, Opportunities and Challenges Facing Domestic Critical Mineral Mining, Processing, Refining, and Reprocessing (Washington, DC: GPO, 2024), 1–2.

34. Hearing Examining the Methodology and Structure of the U.S. Geological Survey Critical Minerals List, Oversight Hearing before the Subcommittee on Energy and Mineral Resources of the Committee on Natural Resources, U.S. House of Representatives, 118th Cong. (13 September 2023).

35. Hearing Examining the Methodology and Structure of the U.S. Geological Survey Critical Minerals List, 7–10.

36. Hearing Examining the Methodology and Structure of the U.S. Geological Survey Critical Minerals List, 17–18.

37. Digging Deeper: Ensuring Safety and Security in the Critical Mineral Supply Chain, House Oversight and Accountability Subcommittee on Economic Growth, Energy Policy, and Regulatory Affairs, 118th Cong. (2023), 2.

38. Digging Deeper, 6; 42 U.S.C., Energy Independence And Security; An Act to Promote the Development of the Mining Resources of the United States, 17 Stat., 42d Cong. (10 May 1872); Mineral Leasing Act of 1920, 66th Cong. (25 February 1920); and Materials Act of 1947, 61 Stat. 681, 75th Cong. (31 July 1937).

39. Digging Deeper, 9–10.

40. Digging Deeper, 12–13, 15–16; and Final Report: Recommendations to Improve Mining on Public Lands (Washington, DC: Department of the Interior, 2023).

41. Digging Deeper, 10–11.

42. See Digging Deeper, 12–13; and Final Report: Recommendations to Improve Mining on Public Lands (Washington, DC: Biden-Harris Interagency Working Group on Mining Laws, Regulations, and Permitting, 2023).

43. Critical Minerals: Status, Challenges, and Policy Options for Recovery from Nontraditional Sources (Washington, DC: Government Accountability Office, 2024).

44. Critical Minerals, 3.

45. Wischer and Bazilian, “The Rise of Great Mineral Powers,” 165.

46. See Occupational Outlook Handbook (Washington, DC: Bureau of Labor Statistics, 2024), 1.

47. A Federal Strategy to Ensure Secure and Reliable Supplies of Critical Minerals (Washington, DC: Department of Commerce, 2019), 4–5.

48. Wischer and Bazilian, “The Rise of Great Mineral Powers.”

49. FACT-41 refers to Title 41 of the Fixing America’s Surface Transportation (FAST) Act. See Critical Mineral Consistency Act of 2024, 118th Cong. (1 November 2024); and “What Is the Permitting Council?,” Federal Improvement Steering Council (Permitting Council), accessed 21 April 2025. See also 170 Cong. Rec. S6610 for this legislation being introduced in the Senate and referred to the Committee on Energy and Commerce.

50. See Ministry of Natural Resources Mandate Letter (Ottawa, Canada: Office of the Prime Minister, 2021), 4; and Kenny William Ie, “Ministerial Policy Roles and Mandate Letters in the Justin Trudeau Government,” Canadian Public Administration 67, no. 1(March 2024): 40–53, https://doi.org/10.1111/capa.12554.

51. See Joanna Asha Goclawska, 2023 Minerals Yearbook: Denmark, the Faroe Islands, and Greenland (Reston, VA: U.S. Geological Survey, 2025); Greenland’s Mineral Strategy, 2020–2024 (Nuuk, Greenland: Ministry of Natural Resources, 2020); and Greenland: Land of Enormous Mineral Wealth (Washington, DC: Institute for Energy Research, 2025).

52. Elena Safirova, The Mineral Industry of Greenland: 2022 Minerals Yearbook Ukraine (Reston, VA: U.S. Geological Survey, 2025), 49.1–49.4.

53. See “Regulating Imports with a Reciprocal Tariff to Rectify Trade Practices that Contribute to Large and Persistent Annual United States Goods Trade Deficits,” executive orders, White House, 2 April 2025, 1–2, 5–6, 9; and 2025 National Trade Estimate Report on Foreign Trade Barriers of the President of the United States on the Trade Agreements Program (Washington, DC: U.S. Trade Representative, 2025), 85, 228, 268, 377.